- MoneyShow's Trading Insights

- Posts

- Trading Insights 8/15/25

Trading Insights 8/15/25

Mike Larson | Editor-in-Chief

Everything was coming up roses on Wall Street and in Washington. Until Thursday morning at 8:30 am Eastern, that is. That’s when the Producer Price Index (PPI) inflation data dropped for the month of July.

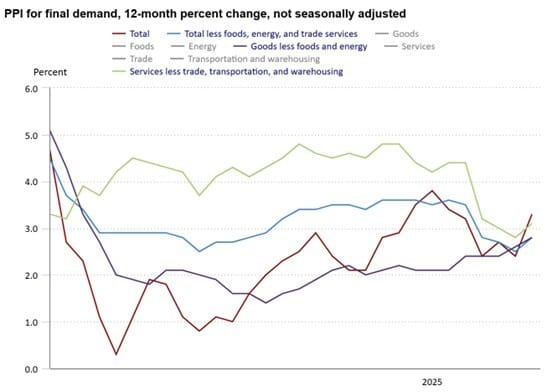

Unlike earlier RETAIL inflation figures, these WHOLESALE inflation numbers were downright ugly. The headline reading rose 0.9% month-over-month, more than 4X the increase economists were expecting. The year-over-year inflation rate surged to 3.3% from 2.4% in June, as you can see in the MoneyShow Chart of the Day here.

Source: Bureau of Labor Statistics

What about the “core” number that excludes food and energy? It also jumped 0.9%, pushing core PPI up to 3.7% YOY. Other measures like “services less trade, transportation, and warehousing” or “goods less food and energy” all moved higher.

What does it all mean?

First, Wall Street will pay even closer attention to what Federal Reserve Chairman Jay Powell says next week at the Fed’s annual gathering in Jackson Hole, Wyoming. He’ll have a chance to “frame” the interest rate debate ahead of the Fed’s Sept. 16/17 policy meeting.

Second, markets STILL think the most likely outcome at that meeting is a 25-basis point rate cut. That would lower the federal funds rate to a range of 4% - 4.25%.

Third, Wall Street would love nothing more than for another pair of cuts to follow in October AND December. Expectations for just such a scenario helped drive stocks higher earlier this week, including a HUGE two-day move in smaller-capitalization names.

But if this is the start of a series of reports suggesting greater pass-through effects from higher tariffs, that’s going to look more and more fanciful. And that could give both stock AND bond markets agita. Keep that in mind with stocks trading in rarefied air.

In this episode of the MoneyShow MoneyMasters Podcast, Peter Schiff, chief global strategist at Euro Pacific Asset Management, returns with his most urgent warning yet about the US dollar and the bond market.

He explains why de-dollarization is accelerating as foreign central banks dump US Treasuries for gold, why silver may be ready to outperform, and how tariff policy will backfire on the US government and the bond market. Schiff also warns the Fed has lost control of long-term rates and says the real crash will come when rate cuts and QE return, locking in stagflation and sending the dollar index toward 40.

IWM: Why Small Caps are Surging – and How to Trade it

👉️ TICKER: IWMAfter the July CPI print came in better than expected, it virtually guaranteed that a rate cut is slated for September. That acknowledgement ignited a monster small-cap rally, as you can see by looking at the iShares Russell 2000 ETF (IWM), highlights Lucas Downey, co-founder of MoneyFlows.

EBAY: Powerful Momentum, Wall Street Backing Make it a Solid Trade

👉️ TICKER: EBAY

Valued at $44.4 billion, eBay Inc. (EBAY) is an online shopping site that has evolved from a relatively small community user-based auction host to a commercial behemoth. It checks the boxes I like to see – including superior current momentum in both strength and direction and a Trend Seeker “Buy” signal, writes Jim Van Meerten, analyst at Barchart.

What did you think of today's newsletter? |