- MoneyShow's Trading Insights

- Posts

- Trading Insights 7/25/25

Trading Insights 7/25/25

Mike Larson | Editor-in-Chief

Institutional investors are the “Smart Money.” Retail traders are the “Dumb Money.” That’s what people have whispered on Wall Street for a long time.

But maybe it’s time to rethink that “Dumb Money” moniker! Because retail investors have stuck with this market – and they’re getting PAID for doing so.

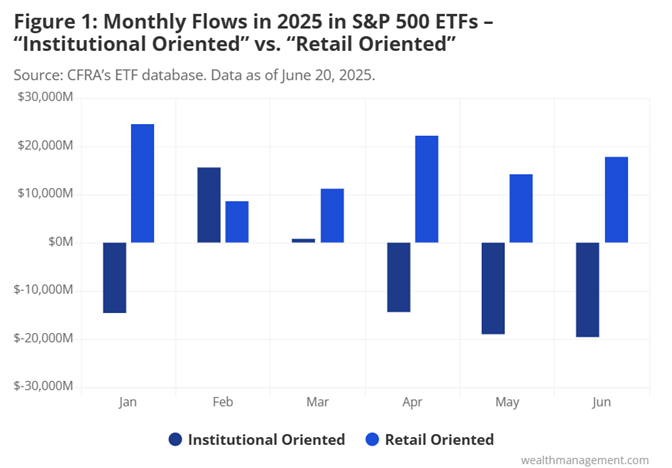

Take a look at the MoneyShow Chart of the Day, which comes from a piece CFRA Research’s Aniket Ullal wrote in late June for WealthManagement.com.

He broke down monthly flows in 2025 by “retail oriented” and “institutional oriented” ETFs. The SPDR S&P 500 ETF Trust (SPY) and iShares Core S&P 500 ETF (IVV) were his proxies for institutional buying and selling, while the Vanguard S&P 500 ETF (VOO) and the SPDR Portfolio S&P 500 ETF (SPLG) were his gauges of retail activity. He admits the methodology isn’t “absolute,” but “directionally useful.”

What’s the verdict? Even as the “Smart Money” was selling stocks in April, May, and June during the tariff-related volatility and economic uncertainty...the “Dumb Money” was buying them. And the “dumb” traders are the ones making money!

As long as buying the dip keeps working like this, you can expect it to continue. That, in turn, is the kind of fuel that can keep the markets marching higher. Not to mention make the “Dumb Money” moniker look more and more outdated. Or just plain wrong.

Tariffs of at least 15% on virtually every US trading partner? Political meddling at the Federal Reserve? Meme Stock Mania 2.0 in full swing? Sure. But stock markets keep trading to new highs ANYWAY. Why? Here’s MY take from our MoneyShow YouTube Channel.

Get Actionable Picks & New Strategies for this Market - FREE!

Are you an investor looking for TRUE value in the markets? Then this Expo is just the ticket! Leading value stock and dividend-focused experts will pull back the curtain on their methodologies – and deliver a host of recommendations you can put to work in your portfolio right away.

With money rotating out of “Mag 7” names...and value stocks having their day in the sun...you’ll benefit greatly from this chance to expand and diversify your portfolio!

NVDA: When AI Stocks Stumble, Don't Get Shaken Out

👉️ TICKERS: AVGO, CSCO, NVDAOccasionally, we will close existing positions, even when we expect much higher prices in the longer term. This process is about managing the ebbs and flows of the market. But don’t worry about the future of tech stocks like Nvidia Corp. (NVDA), advises Joe Markman, editor at Digital Creators & Consumers.

SLDP: A High-Momentum Battery Play for Speculative Traders

👉️ TICKERS: SLDP

Valued at $724 million, Solid Power Inc. (SLDP) is a developer of all-solid-state rechargeable battery cells for electric vehicles and mobile power markets. I sorted for stocks with the highest technical buy signals, superior current momentum in both strength and direction, and a Trend Seeker “buy” signal. I then used Barchart’s Flipcharts feature to review the charts for consistent price appreciation. SLDP checks those boxes, writes Jim Van Meerten, analyst at Barchart.

What did you think of today's newsletter? |