- MoneyShow's Trading Insights

- Posts

- Trading Insights 2/9/26

Trading Insights 2/9/26

Mike Larson | Editor-in-Chief

Sure, tech stocks have gotten pummeled in 2026. But there’s more to life (and portfolios!) than tech. Seven out of 11 S&P 500 Index (^SPX) sector ETFs were showing positive returns as of last Thursday – demonstrating the benefits of digging a bit deeper as an investor.

Take a look at my MoneyShow Table of the Day. Yes, technology is bringing up the rear this year, down 5.7%. But energy is a having a great 2026, up 16.7%. Consumer staples (11.8%) and basic materials (11.3%) are doing just fine, too. Even a couple of the losing sectors (communication services and consumer discretionary) aren’t hurting you THAT much.

S&P 500 Sector Performance (YTD % Change)

Source: State Street Investment Management

The bottom line? A little bit of homework can go a long way. Katie Stockton of Fairlead Strategies shared some of the sectors and stocks she’s favoring in our latest MoneyShow MoneyMasters Podcast. They’re definitely worth a look.

I also shared some thoughts last week on what it means for the broader markets. The short version is this: Stock market ROTATION is fine. Stock market LIQUIDATION is the real problem. As long as money that’s leaving sectors like tech shifts to other sectors – rather than cash – the overall market can do okay. So far, so good on that score!

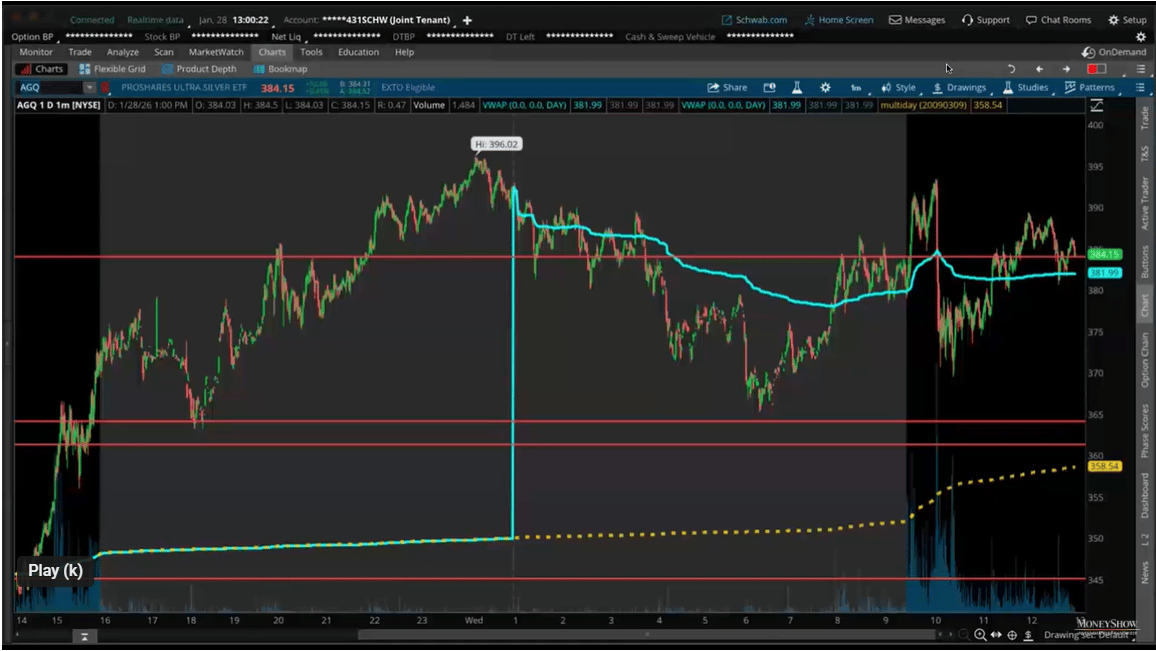

Kenny Glick has often been referred to as the grandfather of day trading. Previously an SOES bandit and tape reader, he now focuses all his trading on VWAP (Volume-Weighted Average Price). In this briefing from our recent MoneyShow Virtual Expo, he demonstrates how you can use VWAP to guide your trading decisions.

SPX: Put Buying Soars, Despite Markets Trading Near All-Time Highs

👉️ TICKERS: MSTR, XLK, SPXWhen it comes to put-buying, we see names “going convex.” To place this into context, the S&P 500 Index (^SPX) was recently 3% off of all-time highs, which were set just a few days ago. But suddenly, the world is a disaster and we see certain subsectors getting absolutely wrecked (software, crypto, etc.), observes Brent Kochuba, founder of SpotGamma.

AI Stocks: Where Things Stand After Brutal Selloff

The ratio of the Roundhill Magnificent Seven ETF (MAGS) to the Defiance Large Cap ex-Mag ETF (XMAG) peaked at a record high of 3.09 on Nov. 3, a few days after Michael Burry trashed the AI trade in an Oct. 27 post. It fell to 2.76 last week, notes Ed Yardeni, editor of Yardeni QuickTakes.

What did you think of today's newsletter? |