- MoneyShow's Trading Insights

- Posts

- Trading Insights 11/19/25

Trading Insights 11/19/25

Mike Larson | Editor-in-Chief

You might want to sit down for this one. As of this week, Treasury Bills are outperforming Bitcoin on the year! The bigger question for cryptocurrency traders, of course, is what happens NEXT?

Take a look at this week’s MoneyShow Chart of the Day, which compares the total return of the State Street SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) to the iShares Bitcoin Trust ETF (IBIT). There it is in purple and orange – a gain of 3.6% vs. a loss of 1.7%. Bitcoin's relative performance looks a little worse against the iShares 20+ Year Treasury Bond ETF (TLT), up 5.7%. And it looks hideous when compared to the SPDR Gold Shares (GLD), up 53.4%.

BIL, IBIT, GLD, TLT (YTD Total Return)

What’s happening? As this Bloomberg story notes…

“Once promoted as a high-growth play, an inflation hedge, and a portfolio diversifier, the world’s largest cryptocurrency now faces the prospect of ending the year in the red — without fulfilling any of those roles.”

Some holders got scared out of crypto by the liquidation event back in mid-October. Others are trading crypto as a tech-stock-adjacent asset, so recent selling in Nasdaq and AI names has spilled over into the crypto world. Plus, the euphoria surrounding a lighter regulatory touch in Washington and broad-based ETF inflows has faded.

Can anything turn the ship around? It’ll likely take a broader stabilization in the tech sector to rekindle risk-on trading in crypto. If Federal Reserve rate cut forecasts pick up, and the US dollar rolls back over, that could help, too. The passage of time and some sideways chop could also set the stage for a fresh leg up by weeding out the week hands.

At some point before long, though, I’d venture that Bitcoin will find its footing – and outperform T-Bills. Not by a small margin, either!

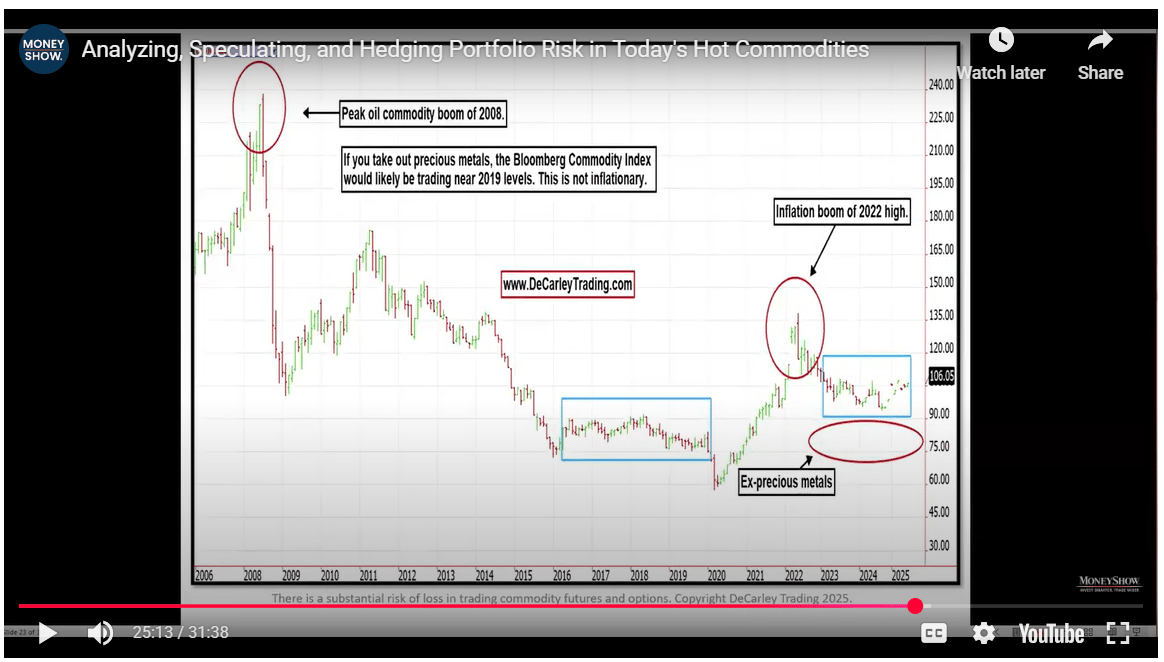

Carley Garner is an experienced futures and options broker with DeCarley Trading, a division of Zaner Financial Services, in Las Vegas. In her session from this week’s MoneyShow Virtual Expo, Carley shares her market analysis on a wide range of commodities, as well as actionable trading ideas and strategies for speculating or hedging price risk.

SPX: Weaker Breadth, Rising Volatility Among Recent Warning Signs

👉️ TICKERS: QQQ, SPXMajor US indices experienced their largest one-day decline in over a month recently. The major averages continue to hold support despite an increase in intraday volatility. But market breadth has weakened considerably and is flashing warning signals, writes Bonnie Gortler, CEO of BonnieGortler.com.

Oil: Trending Lower, But Catching a "Fear Bid"

👉️ TICKER: USO

Commodities came for sale to start the week as a stronger dollar hit the metals complex hard. Energy held up relatively well, but still declined amid risk-off money flows. WTI crude oil futures fell a relatively modest 0.5% to notably end the session slightly below the psychological $60/barrel mark, highlights Tom Essaye, president of the Sevens Report.

What did you think of today's newsletter? |