- MoneyShow's Trading Insights

- Posts

- Trading Insights 10/27/25

Trading Insights 10/27/25

Mike Larson | Editor-in-Chief

Few industries had more tariff-related roadblocks put in their paths than the automobile sector. But you wouldn’t know it by looking at auto stocks. They’re all cruising since the “Liberation Day” lows!

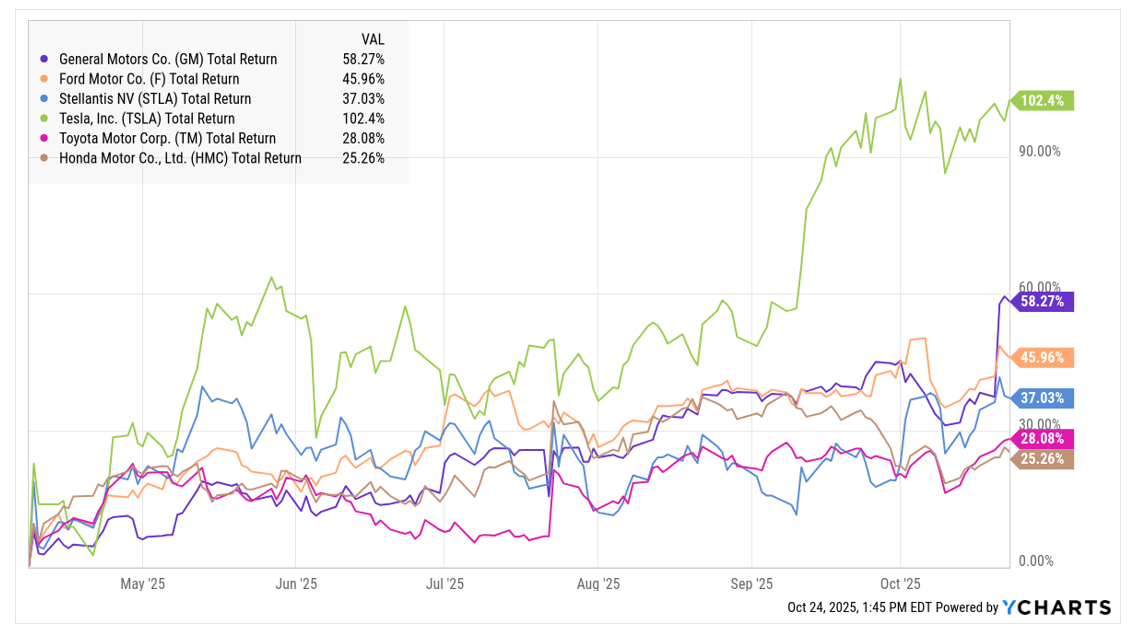

Take a look at the MoneyShow Chart of the Day. It shows how shares of major US-based and foreign-based auto makers have performed since early April. They’ve surged anywhere from 25.2% – for Honda Motor Co. (HMC) – to 102.4% -- for Tesla Inc. (TSLA). The “Big Three” are up 37%, 45.9%, and 58.2%!

Auto Stocks Cruising to New Highs

How can that be? Just look at their recent earnings reports. Domestic sales were relatively healthy at General Motors Co. (GM), Ford Motor Co. (F), and Stellantis NV (STLA). Environmental regulations are being eased, saving car and truck makers billions of dollars. Plus, the Trump Administration has watered down some of its tariffs on autos and auto parts – and industry players have responded by lowering their tariff cost estimates.

Yes, subprime auto loan delinquency rates remain very high. And yes, a handful of lenders to car buyers with weak credit have gone bankrupt.

But again, the trading action in auto stocks speaks volumes about what investors think: The industry has plenty of pothole-free road ahead. If you’re looking for stocks in an uptrend to trade, auto names may be worth targeting.

Stocks are hitting fresh highs…again! So, what should smart traders keep in mind? Peter Tuchman, moderator-in-chief at the Wall Street Global Trading Academy, shared several pointers in a special presentation for the 2025 MoneyShow Toronto. Check out his remarks HERE.

Options Overlay ETFs: What to Know if You're Trading These Popular Funds

👉️ TICKERS: JEPQ, JEPIFrom dividends to pass-through entities and options overlays, there are practical ETF strategies for generating income – but trade-offs behind each approach. Traders should be cautious with options overlay ETFs, writes Tony Dong, lead ETF analyst at ETF Central.

KOPN: A Defense and Industrial Tech Play with Powerful Momentum

👉️ TICKER: KOPN

Valued at $602 million, Kopin Corp. (KOPN) is a leading developer and provider of innovative wearable technologies and solutions for integration into head-worn computing and display systems to military, industrial, and consumer customers. Since the Trend Seeker signalled a new “Buy” on Aug. 26, the stock has gained 73.8%, advises Jim Van Meerten, analyst at Barchart.

What did you think of today's newsletter? |