- MoneyShow's Trading Insights

- Posts

- Trading Insights 10/10/25

Trading Insights 10/10/25

Mike Larson | Editor-in-Chief

What’s ailing the BDCs? The abbreviation stands for Business Development Companies, specialized lenders whose stocks are popular for the generous income they pay out. Lately, they can’t seem to get out of their own way.

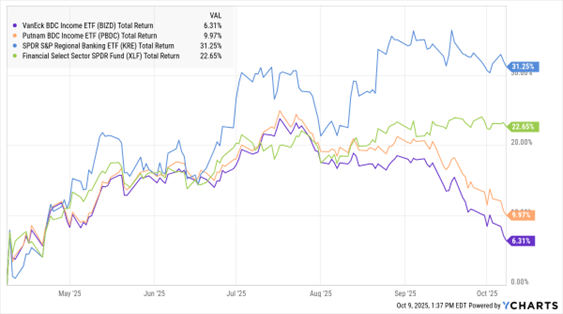

Take a look at the MoneyShow Chart of the Day. It shows how two benchmark BDC funds – the VanEck BDC Income ETF (BIZD) and Putnam BDC Income ETF (PBDC) – have performed over the last six months. It also includes the six-month percentage change in the SPDR S&P Regional Banking ETF (KRE) and Financial Select Sector SPDR Fund (XLF).

BDCs Sliding Even as Banks, Financials Rise

If you’re a long-time reader – or have seen my presentations at live MoneyShows – then you know I pay VERY close attention to credit markets. Subtle problems there can sometimes snowball into problems for the markets and economy as a whole. That's why I find this action interesting.

BDCs make mostly floating-rate loans. Because rates on those loans rise and fall with the federal funds rate, you could argue that recent Fed cuts are behind the weakness. All else being equal, Fed cuts will lower the rates BDC borrowers pay, ultimately lowering the payouts investors earn on BDC shares.

But in THIS environment, BDCs are also seen as a proxy for “private credit” risk. Lending activity fueled by investors, BDCs, and private credit funds has surged as traditional banks have stepped back. BDC assets jumped 33% year-over-year to around $500 billion in Q2 2025, according to JPMorgan. A separate Federal Reserve study found US private credit assets soared 5X to $1.34 trillion between 2009 and 2024.

Some observers (and yes, short-sellers) think private lenders have been too aggressive when it comes to taking on risk. They expect defaults to rise – and the recent decline in BDC shares could reflect those worries.

For now, we’re not seeing broader spillover into the banking sector. But I’d definitely keep an eye on this emerging development. If we see credit risk proxies continue to sell off – and credit spreads start to rise – it’ll be a signal to position more defensively.

Markets have been on a tear for several weeks now, with gold and silver rocketing and retail-favored stocks up 30% just since the start of September. As a trader, should you be worried? You can check out my observations in this MoneyShow Market Minute!

Only SIX DAYS Left ‘Til MoneyShow Orlando — Don’t Miss Out!

There are only SIX DAYS left until we kick off the 2025 MoneyShow Orlando — and you do NOT want to miss out. This year’s signature Central Florida event at the Omni Orlando Resort at ChampionsGate will feature 50+ investing experts, three full days of education and entertainment, and DOZENS of recommendations to turbocharge your portfolio in the year ahead!

SPY: Four Strategies for a Market Where Retail Investors are "All In"

👉️ TICKER: SPYRecent data from Morgan Stanley jumped out at me. Simply put…retail investors are all in. When retail flows hit extremes like this, it’s a sign you’re late in the cycle, not at the start, suggests Lance Roberts, editor of the Bull Bear Report.

IREN: A Growth Stock to Trade Amid Powerful Inflows

👉️ TICKER: IREN

Six months ago, stocks crashed. In fact, we saw the single largest day of outflows since the Covid-19 pandemic crash. But extreme capitulation creates unthinkable rallies. One growth stock under relentless inflows is IREN Ltd. (IREN), writes Lucas Downey, co-founder of MoneyFlows.

What did you think of today's newsletter? |