- MoneyShow's Trading Insights

- Posts

- Trading Insights 1/14/26

Trading Insights 1/14/26

Mike Larson | Editor-in-Chief

Does it pay to trade “left for dead” stocks? Not always. But one former household name in the technology sector is rewarding patient investors – and it provides an object lesson in the benefits of bargain hunting!

Take a look at today’s MoneyShow Chart of the Day, which shows how Intel Corp. (INTC) shares have traded over the last two years. You couldn’t give this chip giant away in late 2024 or early 2025. But it has been moving nicely higher for months – and now it’s breaking out to the upside.

Intel Corp. (INTC)

Source: StockCharts.com

A KeyBanc analyst report provided the latest catalyst. John Vinh upgraded INTC to “overweight” amid operational changes and a pickup in CPU chip sales. An $8.9 billion US government investment last year, plus improving expectations for new chips based on “18A” manufacturing techniques, have also given Intel a leg up.

What REALLY seems to be helping, though, is investor sentiment. Who was left to sell the stock after such a long, painful decline into 2024-2025? Hardly anyone, right? Instead, washed-out sentiment and positioning created the conditions for a rebound – and the catalysts I just highlighted fueled it.

Worth noting: MoneyShow contributor Joe Markman of Digital Creators & Consumers said a turnaround was coming when he recommended INTC for last year’s MoneyShow Top Picks report. Sure enough, the stock is up 140% since then (You can get Joe’s 2026 picks – and everyone else’s – here FREE).

Long story short? Sometimes stocks the market leaves for dead…aren’t REALLY dead. And the rewards for trading them can be sizable.

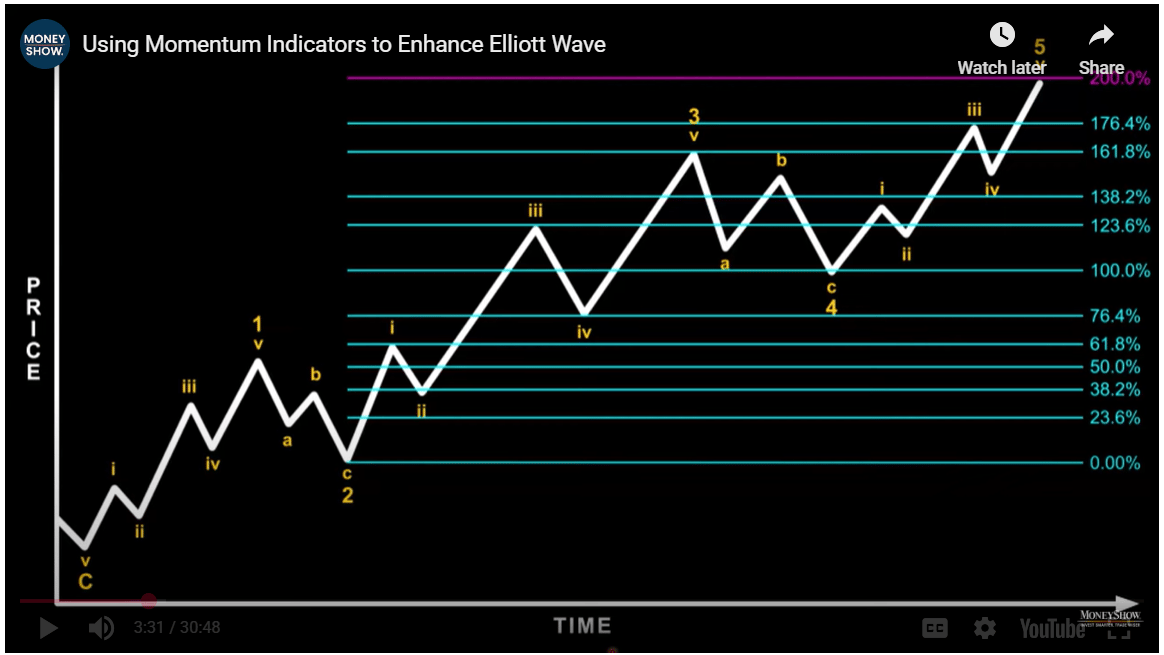

Zachary Mannes is co-host of the Stock Waves & Mining Stocks service within ElliottWaveTrader.net, providing wave alerts and Wave Setups on individual stocks as well as the Miners Model Portfolio. In this MoneyShow Virtual Expo presentation, he explains how traders can use momentum indicators to enhance their Elliott Wave analysis process.

3 Reasons Why You Can’t Miss the 2026 MoneyShow Las Vegas

First is the all-star lineup. Where else can you get critical oil, gas, and renewables insights (and recommendations) from experts like Anas Alhajji of Energy Outlook Advisors? Or future-forward insights and tech trend analysis during an era of massive upheaval from Jason Schenker of Prestige Economics?

Second is the record MoneyMasters Course slate. We have a record-high TEN deep-dive classes waiting for you on-site.

Third is the center-of-it-all venue – and the FUN we have planned. The Paris resort is right in the center of the Las Vegas Strip...and all the dining, entertainment, gaming, and nightlife you could ask for.

Get more details — and secure YOUR event pass — here…

IWM: Why Small Caps Hold the Key to this Market

👉️ TICKER: IWMThe iShares Russell 2000 ETF (IWM) led the market higher last week, gaining 4.6% to close at 260.23, well above the 50-day moving average. If small caps continue to show leadership, it's likely to fuel a broader market advance, advises Bonnie Gortler, CEO of BonnieGortler.com.

Three Stocks for Trading Big Pharma's AI Embrace

Artificial Intelligence (AI) is used in a variety of ways in the pharma industry. You can trade the trend by directly buying shares of pharma companies that have embraced AI…or by opting for shares of companies that power this trend from the tech side, notes Michael Proffe, founder and chief analyst at Proffe Invest.

What did you think of today's newsletter? |