- MoneyShow's Trading Insights

- Posts

- Trading Insights 06/30/25

Trading Insights 06/30/25

Mike Larson | Editor-in-Chief

It’s time to open up the record book. Because we have a new stock market recovery to add to it!

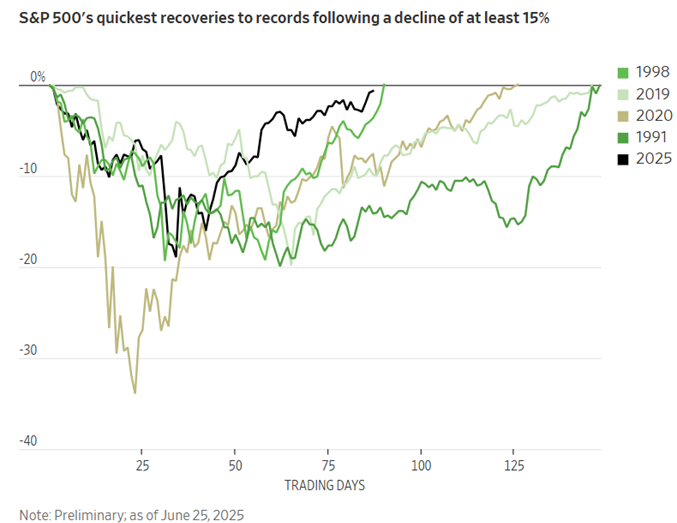

Thanks to the powerful rally last week, the S&P 500 Index (^SPX) not only managed to gain more than 20% from its early April low. It also took just 89 trading days to recoup all the ground it had lost since mid-February – adding $10 TRILLION in value in the process!

That made this the sharpest, swiftest recovery to a new record – from at least a 15% decline – EVER, according to Dow Jones Market Data. This MoneyShow Chart of the Day says it all.

Source: Dow Jones Market Data, via the Wall Street Journal

The remarkable rebound also included a day where the S&P 500 surged 9.5%. That was its single-biggest one-day gain since the depths of the Great Financial Crisis almost 17 years ago. Not even a late-day social media post from President Trump on Friday, which said he was suspending US-Canada trade talks, could derail equities for more than an hour or two.

I laid out the three primary reasons for the powerful rebound in this MoneyShow YouTube Short late last week. Plus, several of our MoneyShow Masters Symposium Las Vegas speakers offered THEIR takes on the rally – and how to capitalize on the recent market action – during an X “Space” last Wednesday. You can listen to the audio recording by clicking HERE and fast-forwarding to the 1:03-to-go mark.

Suffice it to say that the bulls have momentum on their side.

They just put another entry in the stock market record book.

“Offensive” sector ETFs like the Technology Select Sector SPDR Fund (XLK) and Financial Select Sector SPDR Fund (XLF) are leading the way, outperforming “defensive” ones like the Consumer Staples Select Sector SPDR Fund (XLP).

And it’s hard to find much to complain about from a technical standpoint.

So, as a trader…why fight it?

Every stock has a “personality” — and you have to keep that in mind when you’re trading. That’s just one piece of advice Adrian Manz shared in this video excerpt from our MoneyShow MoneyMasters Podcast. The co-founder of TraderInsight.com joined the show at our 2025 MoneyShow/TradersEXPO Las Vegas.

Nasdaq: What a Golden Cross Means for Tech Stock Traders

👉️ TICKERS: AVGO, MSFT, NVDA, QQQThe crowd is excited again. Growth stocks are at all-time highs. The latest development: the Nasdaq-100 Index golden cross. Here’s what it means for tech stock traders, writes Lucas Downey, co-founder at MoneyFlows.

Oil: Why the "Peace Dividend" Could be the Story of the Year

Oil prices are pulling back thanks to a “peace dividend” – along with rumors of an OPEC production hike at the group’s July 6 meeting. Indeed, the historic positive momentum towards peace in the world could be the biggest story in the energy markets this year, writes Phil Flynn, senior energy analyst at The PRICE Futures Group.

What did you think of today's newsletter? |