- MoneyShow's Trading Insights

- Posts

- Trading Insights 06/27/25

Trading Insights 06/27/25

Mike Larson | Editor-in-Chief

Big Tech is SO back. Again.

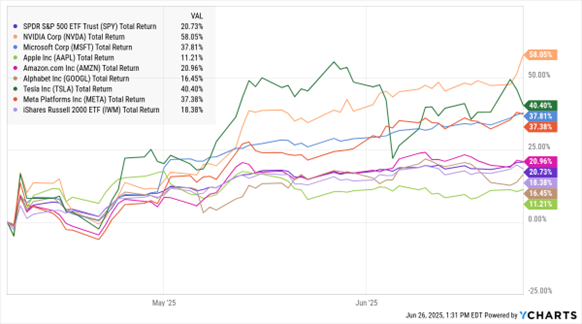

Ever since the stock market bottomed out on April 7, we’ve seen most (though not ALL) of the biggest technology stocks rocket higher. All but two are outperforming smaller-capitalization stocks, as represented by the iShares Russell 2000 ETF (IWM), as well as the SPDR S&P 500 ETF Trust (SPY) -- as you can see in this MoneyShow Chart of the Day.

“Big Tech,” SPY, IWM

(% Change Since April Low)

Nvidia Corp. (NVDA) is the Big Tech name with the most post-“Liberation Day” juice – up 58%. Tesla Inc. (TSLA) isn’t far behind, with a 40.4% rally. Next are Microsoft Corp. (MSFT) and Meta Platforms Inc. (META), both nipping at Tesla’s heels with gains of 37.8% and 37.3%. Only Apple Inc. (AAPL) and Alphabet Inc. (GOOGL) are notably lagging (+11.2% and +16.4%, respectively).

What’s behind the resumption of the Big Tech trade – a trade that has periodically popped back up over the past year or two? A few things...

First, investors are boosting bets on earlier Federal Reserve rate cuts. Lower rates help boost growth-stock multiples.

Second, concerns about tariff and trade policy have eased. President Trump has dialed backed some of his most punitive tariffs – and signaled a willingness to keep negotiating with trade partners. That could prevent some of the worst-case tech supply chain scenarios from playing out.

Third, FOMO is back in play. Investors got too bearish during the declines, didn’t get on board early enough in the subsequent rally, and they’re now dog-piling into old favorites to play catch up.

Add it all up and you have a tech sector that is leading again – and driving the averages to new highs. From where I sit, that’s bullish…and underscores why my “Be (Selectively) Bold” approach (still) looks like the right one here.

Are you making the same day trading mistakes that cost most beginners their accounts? In this episode of the MoneyShow MoneyMasters Podcast, Fausto Pugliese, founder of Cyber Trading University and author of How to Beat Market Makers at Their Own Game, shares the brutal truths about day trading that could have saved you years of losses.

You'll discover why traditional indicators don't work for day trading, how to read level 3 and level 4 quotes to see what market makers are really doing, and the "three T's" methodology for finding profitable trades. You’ll also learn why losing money is actually GOOD for your trading education – and how to spot fake trading gurus who flash fancy cars instead of deliver real results.

SPX: Why a Big Move May be Setting Up – and Which Key Sector to Watch

👉️ TICKERS: SMH, SPXOn the surface, trading volume is down and the summer doldrums are here. But don’t be fooled. A big move is setting up. You can see it in the steady squeezing of the Bollinger Bands around the NYSE Advance Decline Line (NYAD), the S&P 500 Index (^SPX), and the 10-year Treasury yield, observes Joe Duarte, editor of Joe’s Weekender Portfolio.

GD: After Wild Mid-June Trading Action, Here's What to Watch

👉️ TICKER: GD

On June 13, we looked at a wild trade in General Dynamics Corp. (GD). The price of GD hasn’t moved a whole lot since then, only going from $283 to $285.14 recently, but the trailing stop on the -ATR line has ticked up to $260.88, writes Ian Murphy, founder of Murphy Trading.

📈 Robinhood Stock Keeps Surging to New Highs. Valued at $73.3 billion, Robinhood Markets Inc. (HOOD) is a registered broker dealer that provides brokerage clearing services and cryptocurrency trading, among other things. (Barchart)

What did you think of today's newsletter? |