- MoneyShow's Trading Insights

- Posts

- Trading Insights 06/25/25

Trading Insights 06/25/25

Mike Larson | Editor-in-Chief

Cooler heads prevailed in the Middle East this week…and that has put new highs back in play!

Just two days ago, I wrote that “running for the hills probably isn’t the best play.” And I shared a pair of charts illustrating that selloffs driven by geopolitics tend NOT to crush markets over the long term.

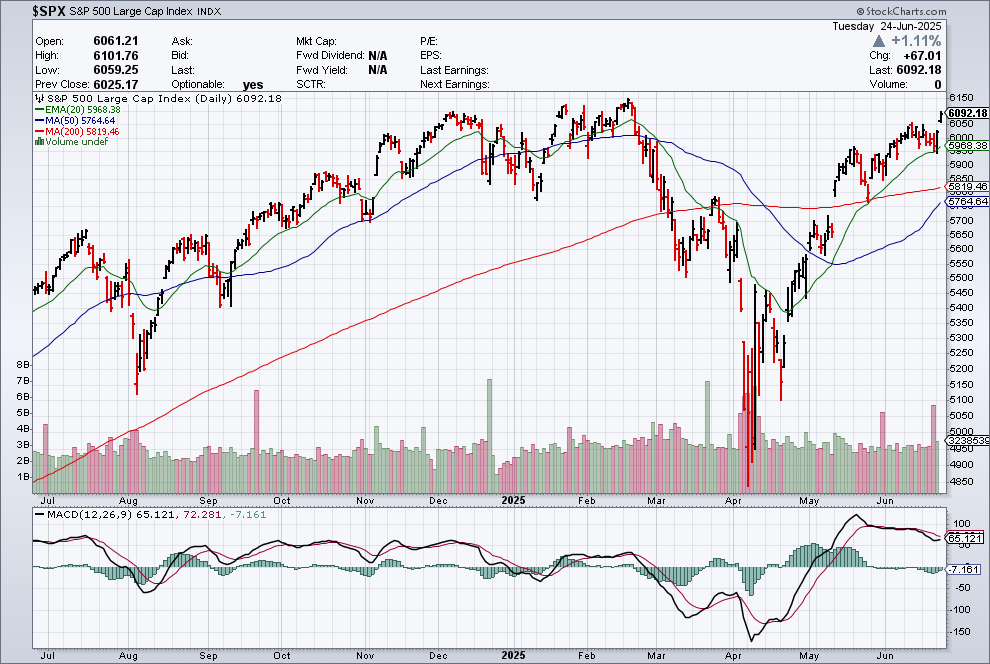

Now, as you can see in this MoneyShow Charts of the Day, we’re only a whisker away from new S&P 500 Index (^SPX) highs! The closing high on February 19 was 6,144.15…compared with yesterday’s close of 6,092.23.

Source: StockCharts.com

Looking at the chart, I’m also encouraged that the move was a “gap” breakout – one that came after several days of consolidation. It also followed a strong test and upside reversal off the 20-day EMA. For good measure, the Invesco QQQ Trust (QQQ) DID close at a new high...though YES, it was only by a smidge.

I’ve been solidly in the “Be Bold” camp for markets since Q1 2023. More recently, I’ve noted that you should stay bold – but in a SELECTIVE fashion. That means zeroing in on particularly strong sectors (financials as an example), asset classes (precious metals), and groups (global/international stocks) with the best combination of macro tailwinds and strong technicals.

That approach has been working. I think it’ll continue to work. And I hope it’s paying off for you!

Michael Turner is president and chief portfolio manager of Turner Capital Investments. In this session from our recent MoneyShow Virtual Expo, he explains how you can turn both bull and bear markets into opportunities for massive growth (without shorting).

Specifically, you’ll learn a proven methodology that has been tested to grow your portfolio at up to 10 times the return of the S&P 500 over a 25-year test period. Learn to ignore the noise by mastering a versatile trading strategy based on rules and discipline.

XHB: Strong Technical Action Suggests Now is the Time to Buy

👉️ TICKER: XHBI’ve been thinking about the housing market a lot lately. Moreover, I’m buying housing stocks because of several developments, writes Steve Strazza, chief market strategist at AllStarCharts.

GM: Why an Options Trade in this Auto Stock Should Pay Off

👉️ TICKER: GM

We just saw a military strike generations of US presidents have avoided...yet stocks took a sizable step back toward record highs. Oil prices actually shifted down, defying all “conventional wisdom” that escalation in the Middle East would endanger global energy transit routes. I like our options trade in General Motors Co. (GM) here, notes Hilary Kramer, editor of High-Octane Trader.

What did you think of today's newsletter? |