- MoneyShow's Trading Insights

- Posts

- Trading Insights 06/23/25

Trading Insights 06/23/25

Mike Larson | Editor-in-Chief

I don’t know what’s going to happen next in the Israel-Iran conflict. No one on Wall Street really knows, either.

But I DO know this: You should look at this double-dose of MoneyShow Charts of the Day…BEFORE you panic and hammer the “Sell” button!

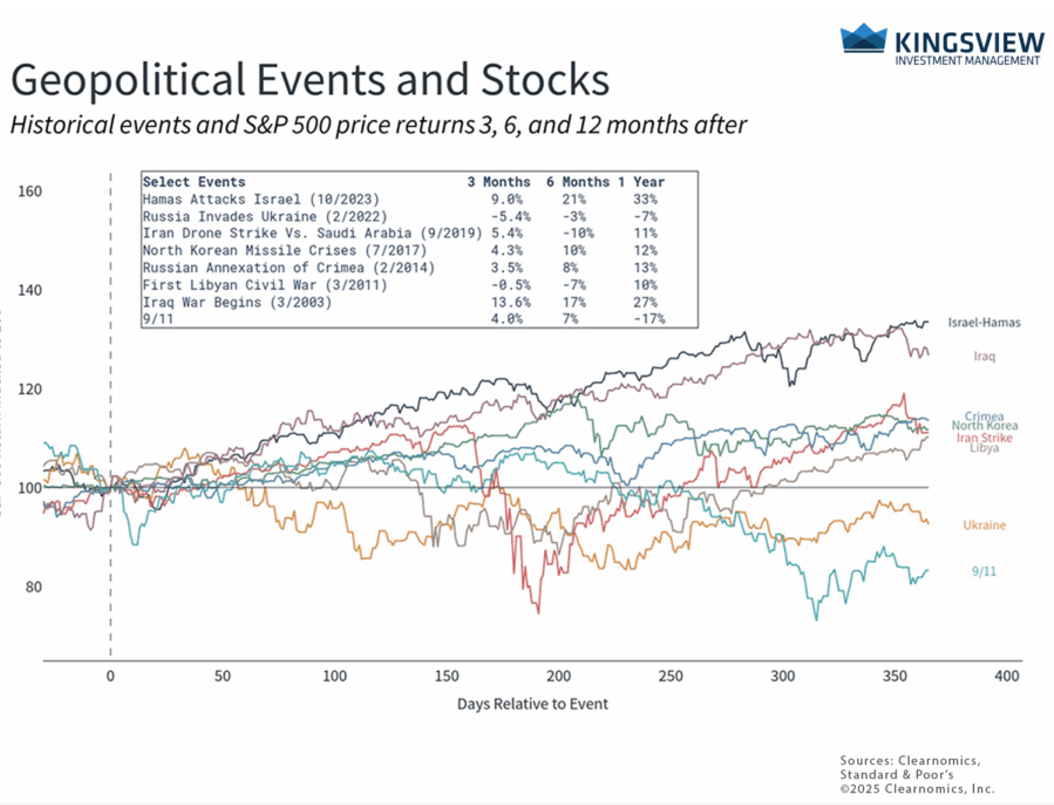

The first comes from Kingsview Partners – with underlying data provided by Clearnomics. It shows what happened to the S&P 500 Index (^SPX) three months, six months, and 12 months after several major and not-as-major geopolitical shocks and conflicts. They range from the worst possible – the 9/11 attacks in 2001 – to a drone strike on Saudi Arabian oil facilities in 2019 (Claimed by the Houthis, with some accusing Iran of backing them).

Source: Clearnomics via Kingsview Partners

The September 11 attacks occurred during the Dot-Com Bust, the 2000-2002 bear market, and a US recession. So, it’s no surprise that stocks ultimately slid 17% over the next year (even as they bounced in the shorter term). Outside of that instance, markets were generally able to recover – and rack up double-digit gains over the next 12 months.

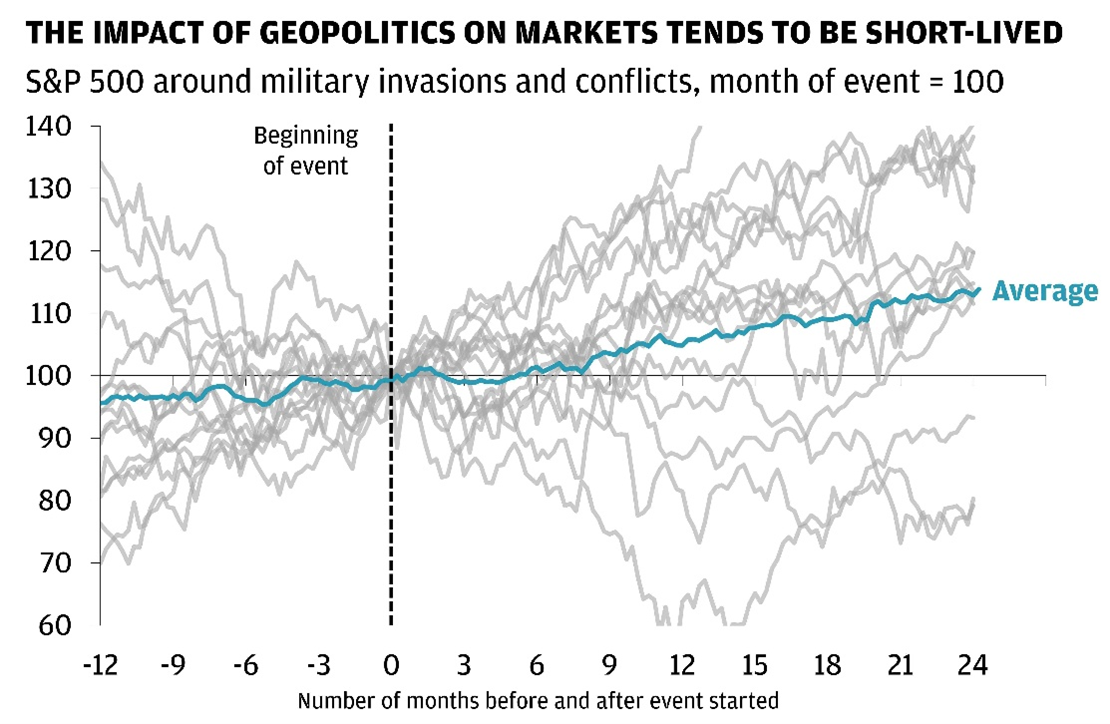

The second chart comes from JPMorgan Asset Management and includes data from many earlier conflicts. They range from the Korean War in 1950 and the Soviet Union invasion of Afghanistan in 1979 to Russia’s invasion of Ukraine in 2022.

Source: JPMorgan Asset Management

Once again, the story is the same. Markets were able to recover from most conflicts in a reasonable amount of time…then reach new highs. The average gain two years after the start of those geopolitical crises was 14%.

Also, if you didn’t see this recent piece featuring work from Lucas Downey of MoneyFlows, you should check it out. It comes to the same conclusion as well.

So, as I write this, I DO NOT KNOW what’ll happen next in the Middle East. But I DO KNOW that as an investor or trader, running for the hills probably isn’t the best play.

Stay rational and level-headed – and keep the historical record in mind.

How much of a “war premium” is currently priced into the crude oil futures market? What will happen with that premium now that the US joined Israel in striking Iran? I shared some thoughts on how things could unfold in this special MoneyShow video update (before the attacks). Check it out on our YouTube channel HERE.

Gold and Silver: Still in "Acceptance" Stage of the Bull Market (Not Mania)

👉️ TICKERS: SLV, GLDGold prices have been ranging for the last two months. That is unwinding the overbought condition. Meanwhile, silver has returned to a position of outperformance, observes Eoin Treacy, editor of Fuller Treacy Money.

SPX and VIX: A Technical Take on Markets and the Mideast Crisis

👉️ TICKERS: SPX

Rhetoric heated up again in the Middle East last week, sending stocks down, WTI and Brent prices up, and VIX futures higher by almost 5% on one day. Patterns on the VIX are tough to gauge, but the volatility index looks to be working on a double bottom, says John Eade, president of Argus Research.

What did you think of today's newsletter? |