- MoneyShow's Trading Insights

- Posts

- Trading Insights 06/20/25

Trading Insights 06/20/25

Mike Larson | Editor-in-Chief

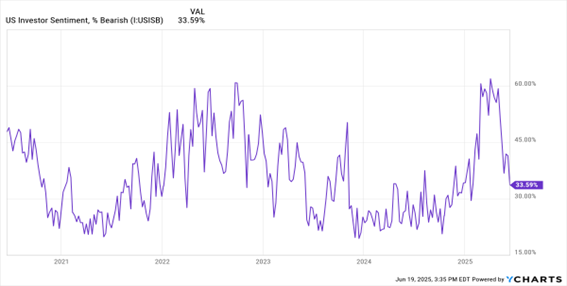

We’ve lost our bears...and that might be a problem.

Take a look at the MoneyShow Chart of the Day, which shows the percentage of respondents to the weekly American Association of Individual Investors (AAII) survey who said they were bearish on stocks. This bearish sentiment indicator surged to almost 62% back in early April. But it just plummeted to less than 34%.

AAII Bearish % Sentiment Indicator

You can see a similar pattern in other investor sentiment indicators, including the CNN Fear & Greed Index. And of course, the CBOE Volatility Index (VIX) has come WAY down from its peak of 52.3 on April 8. It closed at 20.1 Wednesday -- above the low under 17 from early June thanks to the Middle East crisis...but far from a "panicky" reading.

What’s the problem? Isn’t optimism good for us? Maybe in real life. But not necessarily in MARKETS.

You might remember that back in late April, I highlighted how bearish sentiment readings remained VERY high despite a big rally back from the “Liberation Day Massacre.” Investors didn’t really “believe” the rally.

From a contrarian standpoint, that meant it would likely continue. Late-comers and FOMO buyers were still waiting in the wings, providing fuel for more gains if they capitulated and bought. The latest data and market activity suggests that’s EXACTLY what has happened.

Now, we don’t have that cushion of FOMO money. The bears are MIA. So, even if headlines out of the Middle East get less ominous in the coming days, markets may struggle to get much done.

Are the headlines about Middle East energy chaos completely wrong? And how does the Iran vs. Israel conflict impact gold?

In this week’s MoneyShow MoneyMasters Podcast episode, we sit down with energy expert Anas Alhajji, managing partner at Energy Outlook Advisors, and Joseph Cavatoni, senior market strategist for the Americas at the World Gold Council.

Alhajji exposes why Iran cannot truly “close” the Strait of Hormuz (80% of their own imports flow through it) while Cavatoni breaks down the 15-year central bank gold buying trend consuming 25%-30% of annual new gold production. You'll also discover why 83% of Gulf oil flows to Asia rather than the US, how America's energy independence has completely changed the geopolitical equation, and why Chinese and other foreign investors are driving gold prices more than Fed policy.

Just Added to Our Vegas Program: AI Profits Pre-Show Event July 14!

We just put the finishing touches on a special PRE-SHOW event for the 2025 MoneyShow Masters Symposium Las Vegas – and you are NOT going to want to miss it!

Called The Path to AI Profits: Data Centers, Power Sources, Software, & More, it will feature several NEW expert speakers covering Artificial Intelligence trends – and investment picks.

Event speakers include Sydney Armani, chairman and CEO, AI Fintech World Group...Roland McClean, senior associate at The Deal Alliance...Tom Taulli, author of Generative AI: How ChatGPT and Other AI Tools Will Revolutionize Business...Michael Lee, founder of Michael Lee Strategy...Roger Conrad, managing partner at Capitalist Times...and Merlin Rothfeld, senior director at the Trading Academy.

SPX: How Stocks React to Mideast Conflicts – and What to Do NOW

👉️ TICKER: SPXStocks have gone nowhere in the last month. Much of this lackluster performance may be attributed to the Israeli conflict with Iran. So, let’s unpack a Middle East war and market projections playbook for the S&P 500 Index (^SPX). While the future is unknown, we’ve come to learn that overreacting often proves costly, suggests Lucas Downey, co-founder at MoneyFlows.

QQQ: Trying to Regroup, Mount a Charge to All-Time Highs

With the smoke of geopolitical tension lingering on the horizon, the markets just took a measured pause from their recent bullish campaign. But “generals” like the Invesco QQQ Trust (QQQ) remain steadfast and disciplined, still within reach of their all-time highs. Their posture suggests no surrender, only a patient, calculated advance, notes Buff Dormeier, chief technical analyst at Kingsview Partners.

🖥️ Up 101% in 2025, Here's Why This Standout Semiconductor Stock Was Just Downgraded. Navitas Semiconductor (NVTS) is trading lower action after Deutsche Bank analysts weighed in on the tech stock with a mixed note. (Barchart)

What did you think of today's newsletter? |