- MoneyShow's Trading Insights

- Posts

- Trading Insights 06/18/25

Trading Insights 06/18/25

Mike Larson | Editor-in-Chief

Sure, aerospace and defense stocks are strong NOW. The catalyst – more fighting in the Middle East – is on the news 24/7.

But it’s NOT a one-week, one-month, or even one-year story. These stocks have been strong for a LONG time – and the trend is worth paying attention to as a trader.

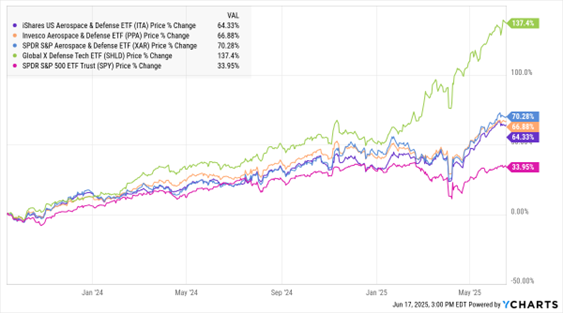

Check out this MoneyShow Chart of the Day. It shows the performance of the $7.6 billion iShares US Aerospace & Defense ETF (ITA), along with other similar, smaller funds from ETF sponsors like Invesco, SPDR, and Global X. I also threw the SPDR S&P 500 ETF (SPY) in for comparison’s sake.

ITA, PPA, XAR, SHLD, SPY (3-Year % Change)

The outperformance is stark. ITA and PPA have returned roughly twice the SPY over the last three years. XAR has done slightly better than that. As for SHLD? It has more than 4X-ed the SPY!

These ETFs have several overlapping holdings – including defense contractors and commercial aerospace names like RTX Corp. (RTX), Boeing Co. (BA), and General Dynamics Corp. (GD). As sector funds, they natrually aren’t broadly diversified. And they will almost certainly pull back if the latest tensions simmer down.

But in this more uncertain world – with more geopolitical threats than ever – are they really worth walking away from? Or are they just the thing to defend your portfolio against volatility? In a world where the US won’t be the only nation spending more on deterrence?

The answer seems pretty clear to me.

With our July 2025 Las Vegas Symposium fast-approaching, check out this episode of the MoneyShow MoneyMasters Podcast filmed from our February event in the city. It features Adrian Manz, co-founder of TraderInsight, talking about what separates successful traders from those who fail. Contrary to popular belief, more trades don’t mean more profits. Instead, Manz explains why focusing on fewer, higher-probability trades is the smarter approach.

Learn How to Allocate Your Portfolio Assets — in Las Vegas!

🎰 Join hundreds of economists, strategists, traders, authors, and fellow investors and traders for the 2025 MoneyShow Masters Symposium Las Vegas July 15-17 — at our ALL-NEW VENUE, Caesars Palace

📈 Get guidance and picks for your stocks, bonds, commodities, real estate, and alternative investments — from experts like Larry McDonald, Mark Mahaney, Victoria Fernandez, Paul Hickey, Stephanie Link, and Louis Navellier

💻 Enjoy live demonstrations, spirited panel discussions, and deep-dive courses on options, precious metals, and cryptocurrency trading — from top traders like John Carter, Michael Khouw, Bob Lang, Huzefa Hamid, and Bruce and Tammy Marshall

SPX: The Key Signal Telling Me to Get More Cautious

👉️ TICKER: SPXThe market has been on a strong run since mid-April, no doubt about that. April lows shook out a lot of investors, but since then we’ve seen a steady climb, with a brief push in early June. Here’s why I’m getting more cautious, writes Gav Blaxberg, CEO of Wolf Financial.

Traders: Watch Tanker Rates, Diesel Market Amid Middle East Tensions

Israel’s military operation against Iran’s nuclear proliferation is called “Operation Rising Lion” but they can also call it “Operation Rising Oil Prices” as it no doubt has impacted the price of energy. Despite wild predictions of what may happen in this type of event, price increases have been relatively modest. However, this operation is raising costs, and we can see it in real time, advises Phil Flynn, senior energy analyst at The PRICE Futures Group.

What did you think of today's newsletter? |