- MoneyShow's Trading Insights

- Posts

- Trading Insights 06/13/25

Trading Insights 06/13/25

Mike Larson | Editor-in-Chief

When you invest, you have two choices: You can invest HERE (where you are) or THERE (where you aren’t.) And right now, a lot of money is leaving HERE and flowing THERE.

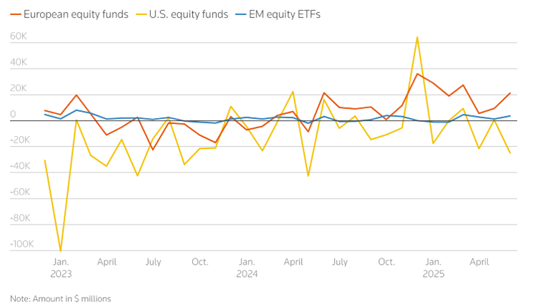

Check out this MoneyShow Chart of the Day. It shows stock ETF money flow data for three different destinations – Europe, Emerging Markets, and the US.

Source: LSEG Lipper

You can see that the yellow line – tracking US flows – is falling…while the red line – tracking European flows – is rising notably. The blue line – tracking EM flows – is climbing more modestly.

The numbers for May alone break down like this:

-$24.7 billion (US)

+$3.6 billion (EM)

+$21 billion (Europe)

Those US outflows were the largest in a year. As for Europe? Not only were May inflows strong, but year-to-date flows totaled $82.5 billion through last month. That’s the most in FOUR years.

What’s going on? President Trump’s trade and tariff policies are prompting some investors to reallocate money out of the US and in to other markets. The US dollar is declining, driving other investors to invest in countries with stronger currencies.

Plus, the relative outlook for economic growth and interest rates is shifting – with expectations for US growth dimming vis-à-vis other countries and regions. See what Steve Schwarzman of Blackstone Inc. (BX) said about investing in Europe, for instance, or what Opening Bell Daily’s Phil Rosen told me about behind-the-scenes weakness in the latest jobs figures.

As a trader, what do you do? Go where the money is going, right? Meaning European or EM funds. You can also consider investments that do well in a declining-dollar environment, like those Huzefa Hamid and Albert Lu covered in this recent MoneyShow MoneyMasters Podcast.

At some point, momentum will shift and money will flow somewhere else. But right now, it’s not going HERE. It’s going THERE.

Israel struck several military, nuclear research, and residential sites in Iran overnight, with multiple Iranian military leaders reportedly killed. We’re seeing significant reactions in global markets — including crude oil, gold, and stocks. This special MoneyShow video update includes my thoughts on what investors and traders should watch for next.

TD: A Canadian Bank Stock with Powerful Technical Momentum

👉️ TICKER: TDValued at $122 billion, Toronto Dominion Bank (TD) is a Canadian chartered bank that offers a wide range of business and consumer services. I sorted for stocks with the highest technical buy signals, superior current momentum in both strength and direction, and a Trend Seeker “buy” signal – and TD checks those boxes, writes Jim Van Meerten, analyst at Barchart.

Nasdaq 100: As Market Fate Hangs in the Balance, Watch These Levels

👉️ TICKER: QQQ

Just when investors began to hope for progress on the global trade front, President Trump reignited tensions with new threats of unilateral tariffs. That announcement sent a shiver through financial markets. From a technical perspective, the Nasdaq 100 future has struggled at the 22,000 mark, which is telling, notes Fawad Razaqzada, technical analyst at Trading Candles.

What did you think of today's newsletter? |