- MoneyShow's Trading Insights

- Posts

- Trading Insights 06/11/25

Trading Insights 06/11/25

Mike Larson | Editor-in-Chief

US and Chinese officials held marathon talks in London this week. The goal? Hammer out a way to move forward, possibly with looser rare-earth export restrictions in China and easier tech export restrictions in the US.

But I’m starting to wonder if the winner of the US-China trade war isn’t...India!

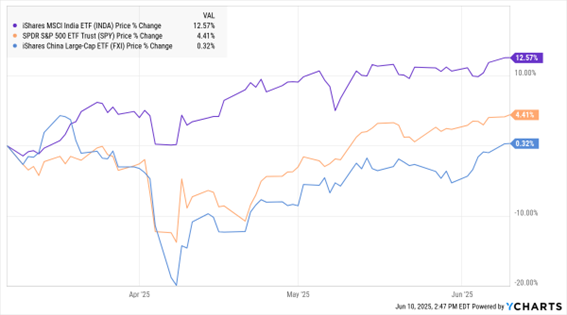

Take a look at the MoneyShow Chart of the Day here. It shows the 3-month performance of the iShares MSCI India ETF (INDA), the SPDR S&P 500 ETF (SPY) and the iShares China Large Cap ETF (FXI).

INDA, SPY, FXI (YTD % Change)

You can see that INDA sold off when the initial volleys in this trade war were fired...but then came back strongly. It's now up more than 12% in the last three months. That compares to a 4.4% rise in the SPY and essentially no change for FXI.

What’s behind that dynamic? Indian Prime Minister Narendra Modi is reportedly eager to make a deal with President Trump. Both sides have since said talks are going well, with Commerce Secretary Howard Lutnick recently forecasting a deal “in the not-too-distant future.”

Other leaks have suggested both sides want “early wins” as the end of the 90-day global tariff pause approaches. And of course, we’re seeing some companies shift production and supply lines to India in a bid to avoid some of the geopolitical ire and pressure directly at China.

Regardless of the reason, funds like INDA are benefiting. Top holdings in the ETF include financial giants HDFC Bank Ltd. and ICICI Bank Ltd., energy plays like Reliance Industries Ltd., and technology sector names like Infosys Ltd. and Tata Consultancy Services Ltd.

If you’re looking to profit from foreign market outperformance, consider the country that looks like a potential winner in the US-China trade war!

Gold is outperforming stocks...and that’s not “normal.” In this MoneyShow MoneyMasters Podcast excerpt, Albert Lu explains WHY it’s happening and HOW to trade the move. The president of Luma Financial has closely followed the metals market…and mining stocks…for many years.

Join Us NEXT WEEK for Our Mid-Year Portfolio Review Virtual Expo!

Get dozens of portfolio picks designed to make the second half of 2025 your best YET – including gold and metals plays, income stocks, alternative investment recommendations, and energy and tech sector names

Explore 25+ exhibitors and booths packed with investment opportunities, downloadable and informative reports, and so much more

Receive a FREE stock report – 10 Top Picks to Buy NOW – after the event...with our compliments.

Bitcoin: Ready to Lead Crypto Higher Following THIS Move

👉️ TICKER: IBITAll things equal, I want the one that shook out the weak hands…before it left the station. I want the one that bears had a clean chance to bury…but couldn’t. I want the one that just trapped the shorts…then squeezed higher. So, let’s talk about Bitcoin, observes Steve Strazza, chief market strategist at AllStarCharts.

SPX: Keep Rolling These Options As Market Conditions Improve

👉️ TICKER: SPX

The downtrend line connecting the February and May highs in the S&P 500 Index (^SPX) was a major impediment on the upside, but now SPX has overcome that. A strong reaction to the unemployment report last Friday led it to trade to new, relative highs. If it can hold this level, new absolute highs should be the next stop, highlights Lawrence McMillan, editor at Option Strategist.

What did you think of today's newsletter? |