- MoneyShow's Trading Insights

- Posts

- Trading Insights 06/09/25

Trading Insights 06/09/25

Mike Larson | Editor-in-Chief

I grew up watching The A-Team as a kid – so the phrase “I love it when a plan comes together” will always be stuck in my head somewhere. And it certainly applies to the action in METALS these days!

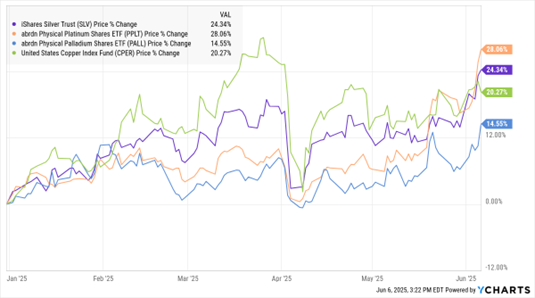

I’ve been talking about how the bull market in gold would likely spread to other metals...and that it was a profit opportunity in the making. So, have many of the best metals experts in our MoneyShow roster. Now, we’re seeing it unfold in real time – as you can see in the MoneyShow Chart of the Day here.

SLV, PPLT, PALL, CPER (YTD % Change)

Silver jumped last week. Platinum soared. Palladium is on the move. Copper lagged, but it’s still up nicely on the year. Amid a hard asset revolution, could energy metals like uranium be next? It’s a thesis getting kicked around by some people I follow closely.

ETFs like the iShares Silver Trust (SLV), abrdn Physical Platinum Shares ETF (PPLT), abrdn Physical Palladium Shares ETF (PALL), and the United States Copper Index Fund (CPER) are easy vehicles to invest in if you’re looking for exposure. Depending on your risk tolerance and preference, you can also trade commodity futures or buy physical metals.

Just keep in mind the importance of timing and key levels, especially if you’re trading shorter term. Bloomberg says platinum ETF flows have risen 3% in the last few weeks, while silver ETF inflows have climbed 8%. At some point, too much money will flood in and it’ll be time to ring the register.

Then again, silver DID trade around $50 an ounce back in 2011. It finished trading last week around $36.

Amy Smith is national speaker and education expert for Investor’s Business Daily. In this MoneyShow Virtual Expo presentation, she explains how IBD’s MarketDiem newsletter gives you hand-picked trade ideas for stocks and options each trading day. You’ll also get smarter trading insights, timely market analysis, and bite-sized investing lessons.

AVGO: A Great Way to Trade the AI Boom

👉️ TICKERS: AAPL, AMZN, GOOGL, QQQ, AVGOInvestors understand that Artificial Intelligence models are only as good as their inputs. Sadly, too few investors use the same rigor when thinking about human neural networks. At Broadcom Inc. (AVGO), AI sales shot up 49% year-over-year – one reason we like the stock, writes Joe Markman, editor at Digital Creators & Consumers.

IBM: After Basing Action, Big Blue Has Been a Beast

International Business Machines Corp. (IBM) is a leading US-based provider of enterprise IT hardware, software, and services. Since May 2023, the stock has been very strong, seeing relative strength versus the Invesco QQQ Trust (QQQ), notes John Eade, president of Argus Research.

What did you think of today's newsletter? |