- MoneyShow's Trading Insights

- Posts

- Trading Insights 06/06/25

Trading Insights 06/06/25

Mike Larson | Editor-in-Chief

I’ve always had a soft spot for the “Utes.” And not just because I think “My Cousin Vinny” is a great movie.

Utilities give you income. They give you safety. They give you stability. But now? Maybe they offer a little bit of EVERYTHING – all that PLUS a growth “kicker” via leverage to tech/Artificial Intelligence (AI) growth.

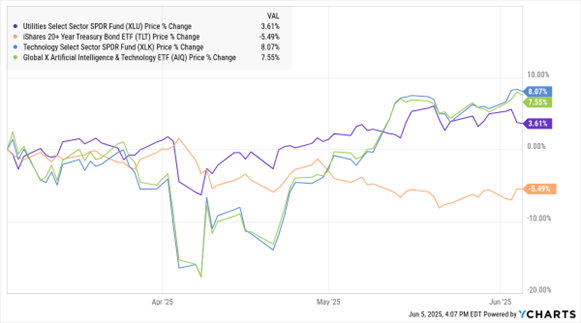

Consider this MoneyShow Chart of the Day – which shows the three-month performance of the Utilities Select Sectors SPDR Fund (XLU), iShares 20+ Year Treasury Bond ETF (TLT), Technology Select Sector SPDR Fund (XLK), and Global X Artificial Intelligence & Technology ETF (AIQ).

XLU, TLT, XLK, AIQ (3-Mo. % Change)

You can see that long-term Treasuries haven’t done well lately. Worries about government debt, ballooning deficits, stubborn inflation, and the falling dollar have driven TLT down more than 5% since March. Thirty-year Treasury Bond yields have climbed about 30 basis points in the same timeframe.

Rising rates USED to be bad for Utes. But for the last few months, XLU has been rallying right alongside XLK and AIQ...rather than getting dragged down by TLT.

Some of our MoneyShow experts have talked about the reasons for this link over the past year. See this piece from Roger Conrad of Conrad’s Utility Investor, or this MoneyShow MoneyMasters Podcast featuring him and Elliott Gue of Energy and Income Advisor.

But regardless of the reasons, my chart take is clear: Utilities seem to offer a little bit of EVERYTHING for traders these days.

A falling dollar and rising gold are offering up a one-two punch of profit opportunities for investors. But how should you play the moves? What else is cooking in forex and precious metals markets? This week’s MoneyShow MoneyMasters Podcast features a double-dose of expert guidance — from DailyForex.com senior analyst Huzefa Hamid and Luma Financial president Albert Lu. Check it out HERE.

The Hottest Ticket in Vegas this Summer: Our 2025 Symposium!

Don’t miss the HOTTEST ticket in Las Vegas July 15-17! Join hundreds of expert speakers, sponsors, and fellow investors and traders at our ALL-NEW venue for 2025 — Caesars Palace!

Get stock picks, trading tips, market insights, and deep-dive economic outlooks from the best money experts in the business!

Find out what’s happening in AI and “Big Tech” from Sydney Armani and Mark Mahaney…how to profit in gold, silver, and oil with Joseph Cavatoni and Carley Garner…what options tactics could pay off handsomely from Michael Khouw and Bob Lang…and MORE!

It’s the hottest ticket in Vegas this summer — don’t miss out!

TLT and SPX: Why Bonds Should Bounce, Taking Stocks Higher

👉️ TICKERS: QQQ, SPX, TLTEverybody assumes that interest rates are going up. And I don't disagree with that in the bigger picture, like 10-15 years. But I'm not worried about 15 years from now. I'm worried about today. So, let's take a closer look at the charts, writes JC Parets, founder of TrendLabs.

SPX: Long Trade Still in Place Following May Trigger

President Trump’s “on again-off again” tariff war continued while I was away, but the S&P 500 Index (^SPX) managed to grind out some gains regardless. In fact, our 52-Week Strategy has chalked up a 9.8% profit since the trigger last month, summarizes Ian Murphy, founder of Murphy Trading.

What did you think of today's newsletter? |