- MoneyShow's Trading Insights

- Posts

- Trading Insights 05/28/25

Trading Insights 05/28/25

Mike Larson | Editor-in-Chief

You’re heard the story. That tariff and trade policy is causing huge issues worldwide – and leaving corporations and investors in the dark about the future.

But is it possible that “uncertainty risk” is...overblown? The MoneyShow Chart of the Day should provide some food for thought on that score!

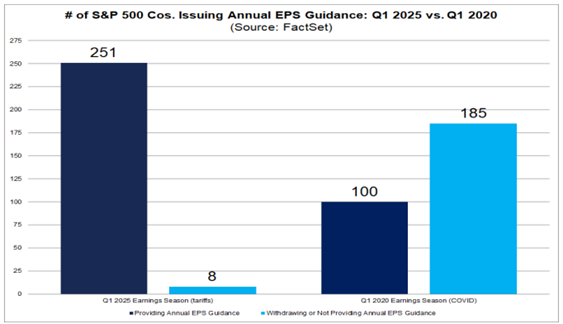

It comes courtesy of FactSet, a firm that provides great insights about earnings trends. The firm reviewed the commentary from the 478 S&P 500 companies who had already reported Q1 2025 earnings through May 22. Some 54% of them (259) offered earnings-per-share guidance for the full year.

But only 8% used the opportunity to withdraw previous projections – or not update prior guidance – due to tariff-driven uncertainty. If you look at the chart, you can see the numbers were MUCH higher during the last major disruption to world trade – the Covid-19 pandemic. Back in 2020, a whopping 185 S&P 500 companies yanked their prior guidance.

How is that possible? FactSet said some companies cited the weaker dollar as a force helping to offset tariff costs. Other companies said supply chain shifts, localization of production, and price hikes would reduce the earnings-suppressing influence of tariffs. Still others just chose not to RAISE guidance due to tariff uncertainty…but didn’t find the threat strong enough to force them to CUT it.

Bottom line? Uncertainty may not be the bugaboo Wall Street once feared. And if that’s the case, the rally off the lows may have more room to run!

Want to be a more successful trader? Then there is ONE trait you should focus on developing each and every day, according to Darren Miller. Check out this “oldie but goodie” video from our MoneyShow interview vault to find out what it is HERE.

Join 100+ Top Money Experts for Our Signature 2025 Las Vegas Symposium!

Discover how to allocate your portfolio assets now — with help from the nation’s leading investing and trading experts! Headlining speakers include Larry McDonald, Michael Khouw, John Carter, Mark Mahaney, and Stephanie Link

Get insightful guidance and actionable recommendations for your stocks, bonds, options, commodities, real estate, and alternative investments

Uncover new ways to profit in red-hot precious metals and cryptocurrencies — and take home dozens of picks you can put to work in your portfolio right away

Plus, you’ll learn cutting-edge strategies and tactics from the nation’s top trading experts. You’ll get to take advantage of the broadest lineup of MoneyMasters Courses EVER. And you’ll enjoy an ALL-NEW venue for 2025 — Caesars Palace!

GLDM: A Great Way to "Buy the Dip" in Gold

👉️ TICKERS: GLDMThe epic volatility in 2025 is a great reminder of the importance of diversification. Adding gold to your portfolio gives you a smoother ride. I recommend trading it using an under-the-radar bullion ETF, SPDR Gold MiniShares Trust (GLDM), writes Alec Young, contributor at MoneyFlows.

NET: Target this Cloud Software Play After Post-Earnings Pop

👉️ TICKER: NET

Cloudflare Inc. (NET) provides cloud-based network services that protect Internet apps and help them run faster – without requiring clients to add hardware, install new software, or change code. After a small flag, NET broke sharply higher on Feb. 7 with massive volume after the company reported results, highlights John Eade, president of Argus Research.

What did you think of today's newsletter? |