- MoneyShow's Trading Insights

- Posts

- Trading Insights 05/21/25

Trading Insights 05/21/25

Mike Larson | Editor-in-Chief

Our 2025 MoneyShow Masters Symposium Miami just wrapped on Saturday. As host of our live events, I’m lucky to have a front-row seat for all the keynote speeches – and many of the in-depth workshops – our experts deliver.

That also means I get a feeling for which themes, sectors, and individual names get the most “buzz.” Three of them stood out to me – and I’m going to share their charts today!

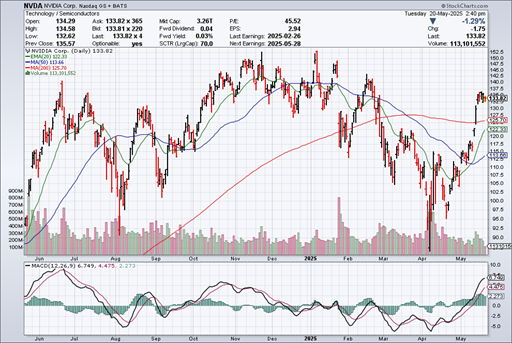

One is the “Big Tech” fav Nvidia Corp. (NVDA). Even though it has gone from rallying nonstop to trading in a WIDE sideways range, several experts still said to stick with it. They think it’s only a matter of time before it gets its mojo back.

Source: StockCharts.com

As you can see in this first MoneyShow Chart of the Day, NVDA is consolidating after a massive rally off the April panic low. If it can clear the $142.50 area, it looks like a move to the old highs could be in the cards.

Next up is the financial sector...which is most easily represented by the Financial Select Sector SPDR Fund (XLF). A few speakers suggested the outlook remains positive here – and I can’t argue with the second MoneyShow Chart of the Day, either.

Source: StockCharts.com

While banks, brokers, insurers, and other XLF stocks got hammered during the tariff-driven selloff, they’ve recovered strongly. If XLF can trade sideways for a bit to catch its breath, I wouldn’t be surprised to see it push through overhead resistance around $52 later.

Finally, let’s talk about a value name that caught some buzz – Boeing Co. (BA). The headlines have been terrible here for the past year-plus. Labor strife. Safety concerns. The tariff fight with China. Boeing has faced it all.

Source: StockCharts.com

But look at my third MoneyShow Chart of the Day. The stock sliced through overhead resistance around $185 recently, then extended its breakout. I don’t know what the future holds for trade negotiations. Investors don’t seem to be too worried, though. The next move could push this name toward old resistance in the mid-to-high $200s (not shown).

I hope this from-the-floor intelligence helps. Next time, consider joining me at a MoneyShow event in person – to get all the buzz your portfolio can handle FIRST hand!

Matthew Williamson brings a unique blend of finance, risk management, and education to his role as a trading coach for SensaMarket. In THIS briefing, discover how institutional traders move the markets and learn to trade alongside them using real-time options flow data. He breaks down how to interpret large block orders, sweeps, and volume spikes — and how to leverage SensaMarket’s 100+ pre-built strategies to maximize your trading edge.

Join 100+ Top Money Experts for Our Signature 2025 Las Vegas Symposium!

Discover how to allocate your portfolio assets now — with help from the nation’s leading investing and trading experts! Headlining speakers include Larry McDonald, Michael Khouw, John Carter, Mark Mahaney, and Stephanie Link

Get insightful guidance and actionable recommendations for your stocks, bonds, options, commodities, real estate, and alternative investments

Uncover new ways to profit in red-hot precious metals and cryptocurrencies — and take home dozens of picks you can put to work in your portfolio right away!

Plus, you’ll learn cutting-edge strategies and tactics from the nation’s top trading experts. You’ll get to take advantage of the broadest lineup of MoneyMasters Courses EVER. And you’ll enjoy an ALL-NEW venue for 2025 — Caesars Palace!

SPX: After Topping 5,800, More Upside Likely Lies Ahead

👉️ TICKERS: QQQ, SPY, SPXThe bulls launched their offensive with the precision of a dawn raid on Monday, May 12, charging out of their blocks and seizing early momentum to begin the week. Strategically, the S&P 500 Index (SPX) has now completed its recovery from the recent correction, but the campaign is not yet won, advises Buff Dormeier, chief technical analyst at Kingsview Partners.

USD/JPY: With the Downward Trend Resuming, How Far Could it Fall?

The USD/JPY is our featured currency pair. We saw some interesting price action last week, suggesting the pair may have resumed its bearish trend again, writes Fawad Razaqzada, technical analyst at Trading Candles.

What did you think of today's newsletter? |