- MoneyShow's Trading Insights

- Posts

- TI 4/28/25

TI 4/28/25

Mike Larson | Editor-in-Chief

Markets have healed a bit. The psyche of investors and traders? Not so much!

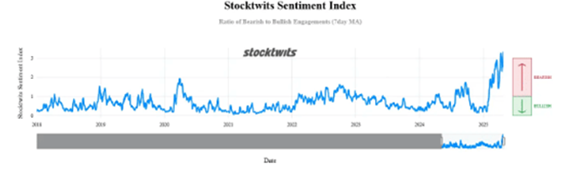

That’s the conclusion you reach when you look at multiple measures of investor sentiment. Since I’ll be attending the Stocktwits Cashtag Awards Wednesday evening in New York, let’s use THEIR indicator – the Stocktwits Sentiment Index – for the MoneyShow Chart of the Day.

Not much bullishness there. As of late last week, it was still at its highest (most bearish) level since the index was launched in 2018.

Source: Stocktwits

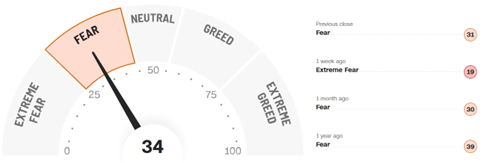

What about CNN’s Fear & Greed Index? It rose a BIT last week from the “depths-of-despair” levels it was hanging out in the week before. But three of its seven component indicators were still in “Extreme Fear” territory. Only one was in the “Greed” zone.

Source: CNN

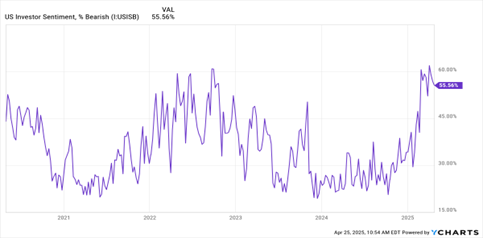

As for the investors who participate in the American Association of Individual Investors (AAII) weekly poll? They tip-toed a BIT further out of the bear cave in the last week. The bearish percentage slipped to 55.5% from the 61.9% peak we saw at the beginning of April. But on a historical basis, these are still VERY elevated levels.

Just as bullish sentiment readings don’t always signal an imminent market top, bearish sentiment readings don’t guarantee a bottom is in. But these do fall in the “potential contrarian indicators” category. And this is a market that can use all the help it can get after a rough couple of months!

When the markets get volatile, the pros get strategic. In this exclusive panel from the 2025 MoneyShow Masters Symposium Dallas, two of the industry’s most respected traders — Dr. Alan Ellman (The Blue Collar Investor Corp.) and John Carter (founder of Simpler Trading and author of Mastering the Trade) — team up to unpack real-time strategies for navigating extreme volatility using options trading.

Whether you're bullish, bearish, or sitting on the sidelines, this panel delivers practical insights you can act on. You'll also gain a fresh perspective on why sometimes sitting in cash is the smartest move — and how to stay ready to strike when opportunity comes. Plus, both experts share how they approach exit strategies and quantify risk using delta and implied volatility.

Bitcoin, Crypto, Trading – Get EXPERT Guidance for Greater Profits in Miami!

Looking to mine greater profits from Bitcoin and other cryptocurrencies? Want to level up your trading game? Then book YOUR PASS to the hottest conference this spring – the 2025 MoneyShow Masters Symposium Miami!

From May 15-17 at the Hyatt Regency Miami, you’ll...

* Learn new crypto strategies and investments from experts like Matt Hougan of Bitwise Asset Management and Digital Assets Professional Craig O’Sullivan

* Get trading guidance and coaching during in-depth MoneyMasters Courses like “Three Key Technical Indicators Every Stock Trader Needs” and our “All Stars of Options Panel” session featuring Dr. Alan Ellman and Bruce Marshall

* Mix and mingle with your favorite speakers and fellow attendees during our VIP reception alongside the Miami River downtown

Plus so much more! Click the link below to register for YOUR PASS to all the education and fun in Miami this May…

Gold & SPX: Amid Back and Forth Trading, Watch These Key Technical Levels

👉️ TICKERS: GLD, SPXTraders are betting that “JJ” will be under real pressure to cut rates IF the labor market unravels. Meanwhile, gold has been on a tear as the ultimate safety trade, but it’s also experiencing a bit of back and forth trading. And while the tone is better for the S&P 500 Index (SPX), we know how fast that can change, explains Kenny Polcari, chief market strategist at SlateStone Wealth.

SSO: An Update on Weekly, Daily Signals After Wild April Action

It’s time to catch up on Weekly Trend Following positions, the 52-Week Strategy, and the ProShares Ultra S&P500 2X Shares (SSO). We looked at this last week, but the indicator didn’t close above zero when the screens were switched off for the weekend, notes Ian Muprhy, founder of Murphy Trading.

What did you think of today's newsletter? |