- MoneyShow's Trading Insights

- Posts

- TI 05/02/25

TI 05/02/25

Mike Larson | Editor-in-Chief

It’s been a while since we had an S&P 500 Index WINNING streak to talk about! Much of the chatter in March and April was focused on LOSING.

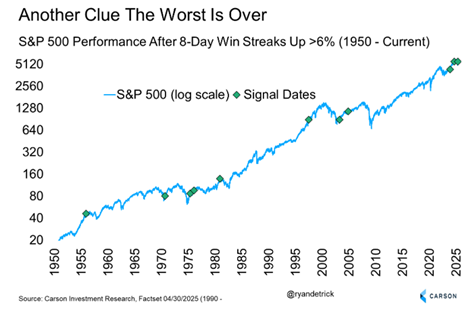

But now that we’ve seen eight “up” days in a row for SPX, what could come NEXT? Let’s go to the MoneyShow Chart of the Day. It’s courtesy of one of my favorite technicians, Ryan Carson, chief market strategist at Carson Group.

You can see what happened historically after rallies of this length and magnitude for the S&P. As Ryan observed, three of four times that happened, stocks were up more than 20% a year later. Not bad.

That also squares with comments Paul Hickey, co-founder of Bespoke Investment Group, made in my MoneyShow MoneyMasters Podcast episode this week. He noted that we just “saw a record spike in the VIX and then almost a record decline in the VIX over a short period.” And he added: “Historically, that’s meant the worst was over and future returns were positive.”

Throw in exceedingly bearish sentiment – ANOTHER contrarian indicator – and you have to be happier with what’s happening out there. Now, let’s see if that nine-day run pans out!

Avi Gilburt is an Elliott Wave market analyst and author of elliottwavetrader.net, a live trading room featuring analysis by a dynamic community of professional traders. In this new MoneyShow Virtual Expo presentation, Avi explains what he sees happening in the stock market — and gold — in the rest of 2025. Check it out HERE.

Zweig Signal Triggered! Here's Why You Should Care

👉️ TICKER: SPXThe generals resumed command of the battlefield last week, surging ahead while their lieutenants and troops followed closely behind. But the week’s biggest story wasn’t just price or volume — it was the rapid reversal in market breadth. Allow me to tell you a story of a man name Zweig, says Buff Dormeier, chief technical analyst at Kingsview Partners.

An Old-School Indicator with a New Message for Traders

Today, most of the financial media is hype-driven headlines and attention-span-destroying garbage. That’s why everybody ignores the finer things, including an old-school indicator. But it says we should be buying stocks, remarks JC Parets, founder of AllStarCharts.

What did you think of today's newsletter? |