- MoneyShow's Trading Insights

- Posts

- TI 04/30/25

TI 04/30/25

Mike Larson | Editor-in-Chief

One chart can’t get out of its own way. One looks much more compelling. And the funny thing is...they’re BOTH in the same sector!

Energy is the industry I’m taking about – and the MoneyShow Charts of the Day show WTI Crude Oil Futures and US Natural Gas Futures.

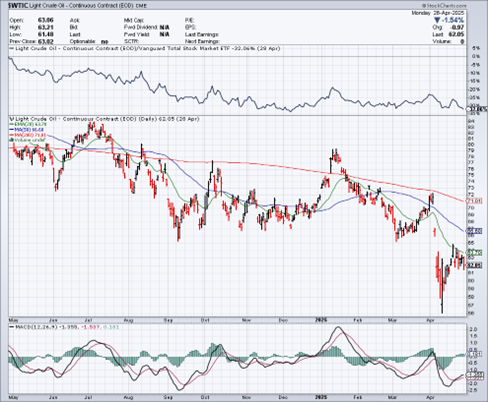

WTI Crude Oil Futures

Source: StockCharts.com

You can see here that crude oil prices traded sideways-to-lower for the better part of the past year. Then in April, they got crushed by the Trump Administration’s tough tariff talk.

The assumption? Global trade and economic activity would tank, driving demand down for the petroleum and oil-based products that fuel it. For its part, the World Bank just forecast that global energy prices would fall 17% in 2025 and another 6% in 2026.

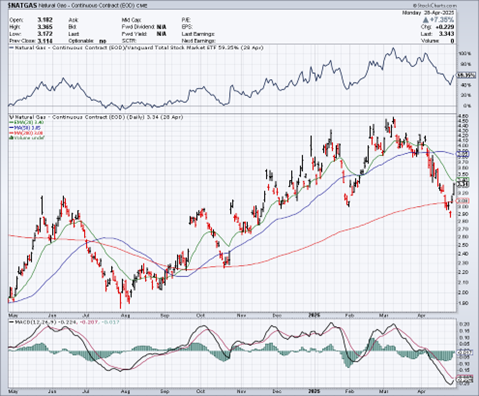

Natural Gas Futures

Source: StockCharts.com

As for natural gas? It traded mostly higher starting last August. While gas prices took a hit in April along with almost everything else, they were still hovering in the $3.30 area earlier this week. That was up about 56% year-over-year.

Weather helped drive those gains. But the bigger story is strong global demand for US gas exports. More US production is being shipped to export terminals, supercooled, and transported overseas as Liquefied Natural Gas (LNG). That’s helping bring domestic prices more in line with higher prices common in other parts of the world.

I’m no energy specialist. But I speak and interact with a lot of the MoneyShow experts who are.

They see continued potential in US gas and related equities vis-à-vis oil and oil stocks. And the charts certainly agree! That’s something to keep in mind if you’re trying to decide where and how to trade energy.

In times of economic uncertainty, the most successful investors aren’t sitting on the sidelines — they’re repositioning. Watch Whitney Elkins-Hutten, director of investor education at PassiveInvesting.com, share a high-level strategy tailored for accredited and high-net-worth investors. You’ll learn how to protect capital, generate stable returns, and prepare for once-in-a-cycle equity opportunities — all by leveraging passive real estate investments designed for today’s market conditions.

Options: Three Bits of Advice if You're Using Straddles to Trade Earnings

👉️ TICKERS: SPX, AMZNThis week’s earnings calendar is even heavier than last week’s, setting up plenty of potential opportunities for pre-earnings straddle buys. Many stocks are showing the classic saw-toothed implied volatility patterns – like Amazon.com Inc. (AMZN), advises Lawrence McMillan, editor at Option Strategist.

NVDA, NFLX: Two Standouts Amid "Political" Purchase Filings

👉️ TICKERS: CACI, NFLX, SMCI, NVDA

Every weekend, I dive into our insider activity tracker looking for the most interesting and bullish buys — and let me tell you, this week didn’t disappoint. Names like Nvidia Corp. (NVDA) and Netflix Inc. (NFLX) stand out amid political purchase filings, notes Steve Strazza, director of research at AllStarCharts.

What did you think of today's newsletter? |