- MoneyShow's Trading Insights

- Posts

- TI 04/23/25

TI 04/23/25

Mike Larson | Editor-in-Chief

Few things are as exciting as “face-ripping” rallies in the stock market. One minute, you’re watching your trading positions sink into the abyss. The next, you’re seeing them soar – and you’re frantically scanning the newswires, social media, or financial television to see what happened.

The only problem? The biggest one-day rallies usually come in BEAR markets, not BULL runs!

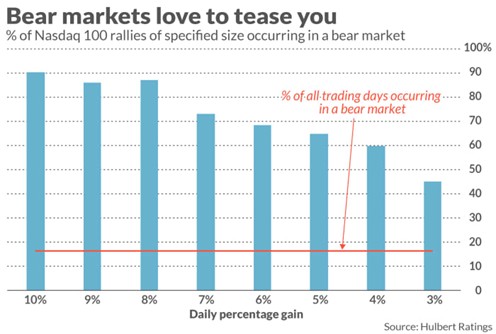

Take a look at this MoneyShow Chart of the Day, with data from Hulbert Ratings and MarketWatch. The Nasdaq 100 was created in 1985. Since then, only 16% of its trading days (through mid-2024) were during bear markets.

Yet a whopping 90% of its biggest “up” days – gains of 10% or more – occurred during bear markets. So, did a sizable majority of its 5%-or-more “face-rippers.”

Then there’s the Dow Jones Industrial Average, the granddaddy of the major indices. Look at this table of its top 10 one-day percentage rallies from Wikipedia.

You can see that six of ten came between 1929-1933...two of the remaining ones were in October 2008…while another was in March 2000. The biggest gain was 15.3% in March 1933, while the tenth-biggest was 9.4% back in February 1932.

If you know your market history, you know a little about those periods of time. They came during, at the start of, or only just after the end of some of the worst Dow bear markets in history!

Keep that in mind when you see days like April 9...or yesterday’s intraday surge. The key to a lasting turn isn’t just a face-ripper or two. It’s a steady, base-building process that can lay the groundwork for a more-durable, more-powerful move.

Is ignoring presidential cycles the worst mistake investors make? Market history suggests we’ll see strength in the first year of the new presidential administration - despite recent market turmoil.

But noted technician Ralph Acampora also covers how the second year of a president's term in office is usually marked with a bear market…and what investors can do in response. Check out his segment recorded at the 2025 MoneyShow Las Vegas HERE.

XLF: Why the Financial Sector Holds the Key to the Markets Here

👉️ TICKER: XLFWe don't have bull markets without the financials. It’s a key sector for markets, not just in the US, but all over the world. So, let’s talk about the Financial Select Sector SPDR Fund (XLF), notes JC Parets, founder of AllStarCharts.

Oil: How to Trade Energy Amid Bullish Supply-Demand Trends

Oil prices weakened after reports that President Trump discouraged an Israeli attack on Iran’s nuclear infrastructure, indicating his desire to avoid war with Iran and give them a chance to negotiate. But the petroleum markets are expected to receive support from recent monthly data, notes Phil Flynn, senior energy analyst at The PRICE Futures Group.

What did you think of today's newsletter? |