- MoneyShow's Trading Insights

- Posts

- TI 04/18/25

TI 04/18/25

Mike Larson | Editor-in-Chief

Every year for the last few decades, we’ve produced an annual “Top Picks” report. It contains the best investing ideas for the coming year from a rotating roster of our top expert contributors.

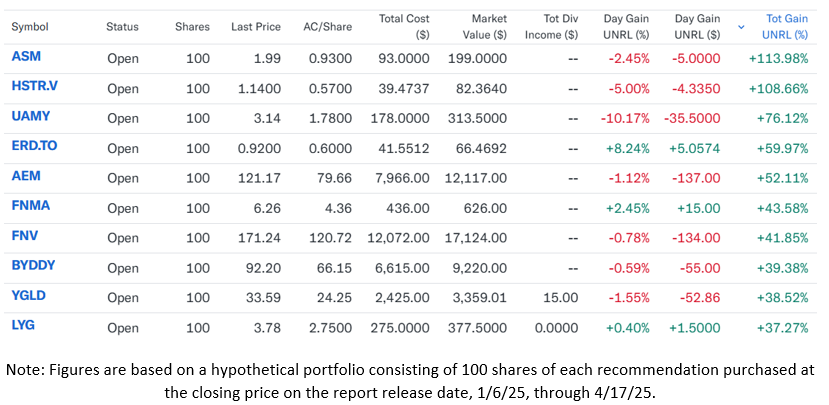

I track them using Yahoo Finance’s portfolio tool…and the MoneyShow Chart of the Day (table, really) speaks VOLUMES about how the market’s character has changed radically. The table shows which recommendations in the 2025 Top Picks Report have performed the best through this week.

The top performer is Avino Silver & Gold Mines Ltd. (ASM), with a tracked gain of 113%. It’s followed by Heliostar Metals Ltd. (HSTR.CA) at +108%, then United States Antimony Corp. (UAMY), Erdene Resource Development Corp. (ERD.CA), and Agnico Eagle Mines Ltd. (AEM) with solid double-digit open gains.

What do they all do? Explore for and mine precious, base, and rare earth metals! Among the top 10 performers, only a couple are in any other sector (financials and consumer discretionary). Federal National Mortgage Association (FNMA) is a “special situation,” too – a highly speculative pick the contributor identified as such from the outset.

Clearly, this is a very different kind of market. One where the makeup of winners and losers is a LOT different than the Magnificent Seven-dominated market we had several quarters back. Be sure to keep that in mind as a trader or investor.

What if the most important signals in the market aren’t on a chart — but in the conversations traders are having online? In this episode of the MoneyShow MoneyMasters Podcast, I’m joined by Tom Bruni, editor-in-chief and VP of community at Stocktwits, the social platform behind the Cashtag and the upcoming Cashtag Awards in NYC.

Tom pulls back the curtain on what Stocktwits' real-time sentiment data is saying about the market — and why retail traders may be more uncertain than ever.

SPX: Should You Be Worried About the "Death Cross?"

👉️ TICKERS: SPXWe recently discussed the decline in the dollar relative to the parade of people trying to get clicks and views by promoting the “death of the dollar.” The next big bearish headline will be the “death cross” of the S&P 500 Index (SPX). It sounds ominous when couched in those terms, but all it means is that the 50-dma has crossed below the 200-dma, notes Lance Roberts, editor of Bull Bear Report.

PSX, SPX, & European ETFs: What I'm Watching Now

Amidst the volatility currently swirling around equity markets, it would be easy to forget about earnings. But the numbers for Q1 2025 are starting to roll in nevertheless. According to analysts surveyed by LSEG, Phillips 66 (PSX) has seen the largest revision of any firm in the S&P 500 Index (SPX), with an expected drop in earnings of -166%, highlights Ian Murphy, founder of Murphy Trading.

What did you think of today's newsletter? |