- MoneyShow's Trading Insights

- Posts

- TI 04/09/25

TI 04/09/25

Mike Larson | Editor-in-Chief

Sure, we’re seeing plenty of volatility in the STOCK market. But wild swings and big moves aren’t just confined to equities anymore.

Take a look at my MoneyShow Chart of the Day, which shows the Merrill Lynch Option Volatility Estimate Index – or “MOVE” for short. While the CBOE Volatility Index (VIX) tracks vol in the S&P 500, the MOVE index tracks vol in the market for options on Treasury notes and bonds.

Source: Google Finance

Sure enough, the MOVE index just spiked above 137. That puts it at the highest level in 23 months. Or in other words, bond yields and bond prices are caught up in the tariff-driven chaos, too.

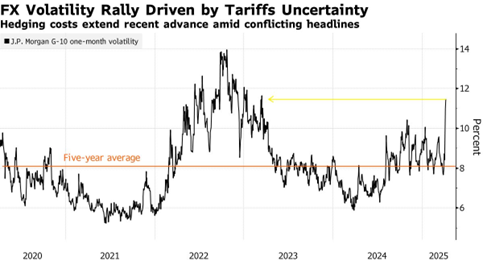

Then consider this bonus chart from Bloomberg. It shows volatility in the foreign exchange (FX) market, using data from JPMorgan Chase & Co. You can see that currency market vol is also hitting levels not seen since early 2023.

Source: Bloomberg

For investors, the implication is clear: Market swings are getting more violent across all major asset classes. That can create new opportunities if you’re a nimble trader. But it also raises the risk of major losses, particularly if you’re using higher levels of leverage. Size your positions accordingly.

Volatility is rising. Uncertainty is everywhere. But what does the CBOE Volatility Index (VIX) actually tell investors and traders? At the 2025 MoneyShow Las Vegas, Steve Sosnick, Chief Strategist at Interactive Brokers, broke down one of the most misunderstood metrics in the markets.

He explained why the VIX isn’t truly a measure of fear, how it’s calculated, and what institutional investors use it for. He also dove into how correlation, dispersion, and options pricing shape the VIX — critical intelligence in a market like this one. Check out the segment HERE.

SPY: Where the Technicals Stand After High-Volume Capitulation

👉️ TICKER: SPYThis past week, the market’s price trend finally aligned with its volume trends, which broke down a month earlier. One more item of note: Volume on the SPDR S&P 500 ETF (SPY) surged to levels not seen since January 2022. This massive SPY volume may indicate a volume sentiment setup for a capitulation bottom, observes Buff Dormeier, chief technical analyst at Kingsview Partners.

SPX: Technical Damage Dictates this Options Trading Approach

👉️ TICKER: SPX

What had been a mediocre, oversold rally failed right where such rallies normally do several days ago -- at the declining 20-day moving average. Then everything changed to a much more bearish scenario after President Trump's announcement of tariffs. Be sure to roll deeply in-the-money options, says Lawrence McMillan, editor at Option Strategist.

What did you think of today's newsletter? |