- MoneyShow's Trading Insights

- Posts

- TI 04/07/25

TI 04/07/25

Mike Larson | Editor-in-Chief

We FINALLY saw volatility take off on Friday. The CBOE Volatility Index (VIX) almost doubled to more than 45 after markets took a second tariff-related dive.

This MoneyShow Chart of the Day shows the recent action – and how we haven’t seen anything like it since last August. Back then, worries about the yen carry trade unwinding fueled a massive, but short-lived, spike.

Source: StockCharts.com

Steve Sosnick is chief strategist at Interactive Brokers, and he did an excellent job explaining how the VIX works and why it matters in a keynote at the 2025 MoneyShow Las Vegas. You can check that briefing out HERE on our MoneyShow YouTube Channel.

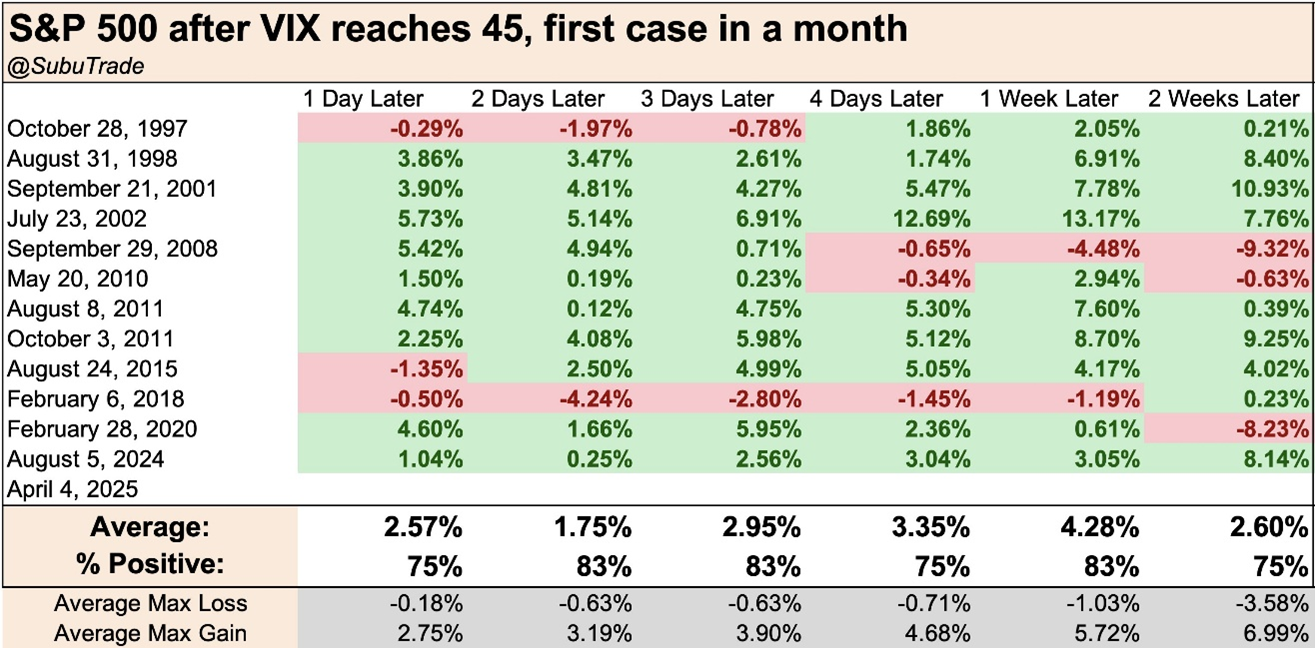

For our purposes, it’s worth looking at what a 45+ VIX has “meant” for markets in the past. The index doesn’t get that high very often…and when it does, it tends to mark a short-term bottom. Check out this table from @SubuTrade on X:

Source: @SubuTrade on X

Going back to the late-1990s, when the S&P 500 topped 45, it traded higher over the next two weeks 75% of the time. Its average gain during those periods was 2.6%. Probabilities were in your favor as a trader over shorter-term timeframes, too.

The only times things really moved against you were during the Great Financial Crisis in September-October 2008 and the depths of the Covid-19 pandemic in February-March 2020. Had you bought the move above 45 in VIX then, you would have been down 9.3% and 8.2% a couple weeks later, respectively.

I can’t guarantee this selloff is over. I can’t guarantee volatility is done spiking. But when there’s panic in the air, it often (but not always) signals that it’s time to buy.

With recent tariff announcements driving significant market chaos, investors are left wondering: Is it time to panic or stay the course? And what asset class provides the best insurance in uncertain times?

In this bonus episode of the MoneyShow MoneyMasters Podcast, I sit down with Brien Lundin, executive editor of Gold Newsletter, to unpack the economic chaos and the case for precious metals. Brien shares his insights on why gold remains a crucial asset, how recent tariff news impacts market sentiment, and what investors should do next. Plus, learn why gold’s resilience might be the key to navigating this volatile environment.

NQ and ES: How to Trade Large Swings in this Volatile Market

👉️ TICKERS: SPY, QQQIf you’re making intraday decisions, this market environment actually may be rewarding given the large swings that create opportunity in capturing moves in ES/NQ futures. If you’re a longer-term investor or an intermediate-term investor in US companies who tends to hold positions, this is a very unfavorable environment. No getting around it, explains Larry Cheung, founder of Letters from Larry.

What I'm Looking for Before Committing More Cash

👉️ TICKER: SPX

The market action is all about President Trump and his tariffs, with opinion divided on political lines on effectiveness of tariffs. Personally, I believe he’s not wrong about manufacturing needing to return to US, but the message gets lost in the divisive messenger. Luckly for us charts don’t have opinions, writes Ian Muprhy, founder of Murphy Trading.

What did you think of today's newsletter? |