- MoneyShow's Trading Insights

- Posts

- TI 03/31/25

TI 03/31/25

Mike Larson | Editor-in-Chief

It’s the end of the first quarter! And boy has the reaction to that statement changed.

Several weeks ago, investors wanted Q1 to go on forever. Now? They can’t wait for it to be over. All because of the swoon that started in mid-February and continued right up until the quarter’s closing days.

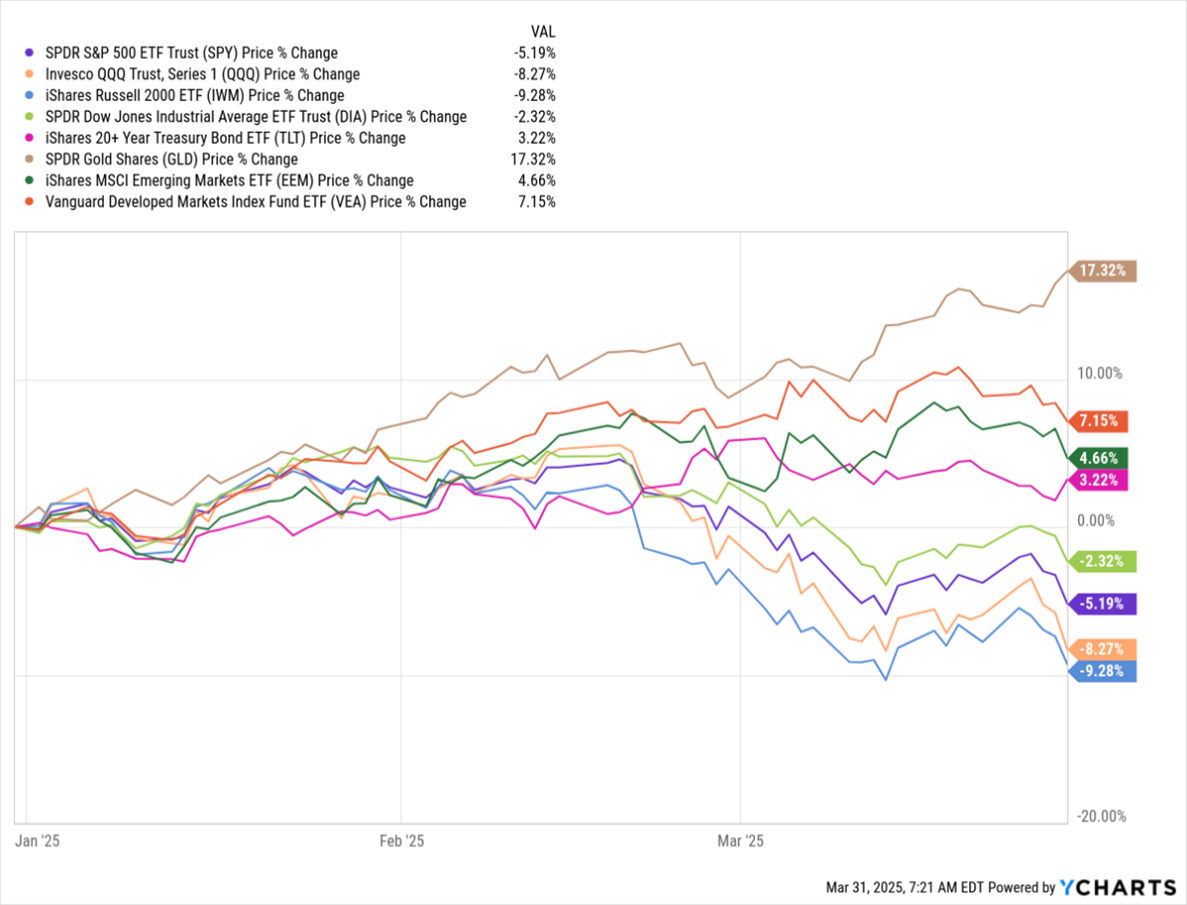

So, where do things stand? Here’s my MoneyShow Chart of the Day. It shows the performance of a wide range of ETFs tracking most major indices and asset classes.

Gold, Treasuries Lead...Small Caps, Tech Lag in Q1?

You can see right away what the big winner was...gold! The SPDR Gold Shares (GLD) gained 17.3% in the quarter, adding to stellar gains it racked up in 2024. Foreign stocks also did well, with the Vanguard Developed Markets Index Fund (VEA) up 7.1% and the iShares MSCI Emerging Markets ETF (EEM) rising 4.6%. Treasuries offered up some protection, with the iShares 20+ Year Treasury Bond ETF (TLT) climbing 3.2%.

On the flip side, small cap US stocks got smoked. The iShares Russell 2000 ETF (IWM) slid 9.2%. Big Tech wasn’t far behind, with the Invesco QQQ Trust (QQQ) down 8.2%. The SPDR Dow Jones Industrial Average ETF (DIA) fared better, losing just 2.3%, while the SPDR S&P 500 ETF Trust (SPY) essentially split the difference, dropping 5.1%.

What happened? What changed the trajectory of markets so radically, so quickly? President Trump’s tariff and trade war campaign is at the top of the list. While the president believes his policies will have significant long-term benefits…Wall Street expects significant, negative side effects in the shorter term.

Investors also started to question the durability of the US economic expansion, given falling consumer confidence and rising uncertainty in Corporate America. Plus, many of the Artificial Intelligence (AI) plays that led the market on the upside gave up significant ground in the quarter. The catalyst: Worries about cutbacks in AI-related tech spending.

So, just what is a common-sense trading strategy? It does the following: Your money grows in up markets, down markets, and flat markets. Your money is liquid all the time. You can get in or out anytime you want. And on top of all of that, you get to choose whether you want a 1x or 2x or 3x growth rate.

See what Mike Turner, president and chief portfolio manager of Turner Capital Investments, LLC, has to say about his market approach in this briefing.

S&P and Dow: A Technical Breakdown of Where the Indices Stand

👉️ TICKERS: DIA, SPXIf this level of uncertainty persists, the market will be hard pressed to make any significant headway. Technically, the S&P 500 (SPX) and Dow Jones Industrial Average have some work to do to find support for any sustainable tradable rally to take hold, highlights Jeff Hirsch, editor-in-chief of The Stock Trader’s Almanac.

SPX: Why Sentiment Flipped So Fast – and What to Watch Now

👉️ TICKER: SPX

During the recent pullback, sentiment went from very bullish to very bearish very quickly. Surprisingly, the S&P 500 (SPX) fell only 10%. Still, we believe certain factors led to this quick change in investor opinions, writes John Eade, president of Argus Research.

What did you think of today's newsletter? |