- MoneyShow's Trading Insights

- Posts

- TI 03/24/25

TI 03/24/25

Mike Larson | Editor-in-Chief

You know I’m a big fan of precious metals like gold and silver. But what other metals and commodities are worth a look?

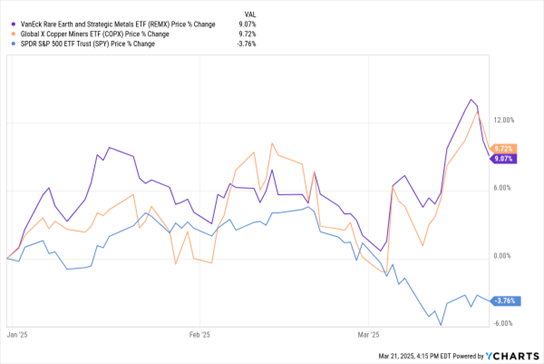

Today’s MoneyShow Chart of the Day sheds some light on the subject. It shows the year-to-date performance of the VanEck Rare Earth and Strategic Metals ETF (REMX) and the Global X Copper Miners ETF (COPX), and how their returns compare to the SPDR S&P 500 ETF (SPY). You can see that these mining ETFs are handily outperforming the S&P – up about 9% in both cases versus a drop of almost 4%.

REMX, COPX, SPY (YTD % Change)

REMX owns companies that produce, refine, and recycle metals and materials like lithium, lanthanum, and titanium. Holdings include Albermarle Corp. (ALB) and Sigma Lithium Corp. (SGML). COPX owns – you guessed it – copper-mining companies. Top positions include Southern Copper Corp. (SCCO), Freeport-McMoRan Inc. (FCX), and Ero Copper Corp. (ERO).

What’s the bull case for NON-precious metals and the companies that mine them?

First, President Trump just signed an executive order designed to boost domestic production of strategic and rare earth materials and elements. That could make it easier for miners to plan, fund, and build out projects here at home. Second, copper prices have rallied in 2025 amid hopes for demand-boosting stimulus in China, plus reports of dwindling mine supply.

So, if you’re looking for OTHER metals and materials plays outside of gold and silver...maybe give these a look in 2025.

Steve Sosnick is chief strategist at Interactive Brokers, a post which entails writing about and talking about key developments in financial markets. In this eye-opening MoneyShow MoneyMasters Podcast episode, which you can watch here, he draws on those experiences to provide critical insights about the current market environment – and how traders and investors can best navigate it.

MHH & INTC: Which Trade is Hot...And Which is Not

👉️ TICKERS: INTC, MHHThe stock market — never a dull moment. Here’s what is moving in both directions right now – one stock that’s hot…and one stock that’s not, says Steve Reitmeister, editor of Zen Investor.

F: Recovering Nicely, Overtaking TSLA as a Solid Trade

The road back from a market correction can be uneven, but sooner or later good stocks recover. The important factor is speed, which is why I’m pleased to see the Triple Digit Trader portfolio has already started shaking off its losses from early this month. One driver: Humble, often overlooked Ford Motor Co. (F), observes Hilary Kramer, editor of Triple Digit Trader.

What did you think of today's newsletter? |