- MoneyShow's Trading Insights

- Posts

- TI 03/12/25

TI 03/12/25

Mike Larson | Editor-in-Chief

Credit markets. Stocks. Gold. Volatility. I’ve written about them all – and what market messages they’ve been communicating – so far in 2025.

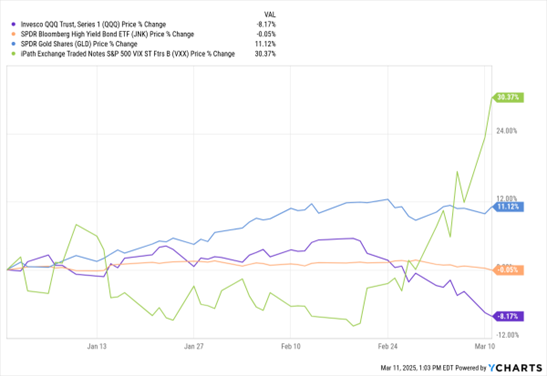

But conditions are shifting...rapidly. So, where do things stand NOW? Here’s a MoneyShow Chart of the Day showing ETFs that track all four markets...and what you need to know!

JNK, QQQ, GLD, VXX (YTD % Change)

Credit? Not good. But not terrible. High-yield bonds held up fairly well during the early stages of the stock market selloff. They’ve started to bend now...but not break. The SPDR Bloomberg High Yield Bond ETF (JNK) is roughly flat on the year, or up a bit on a total return basis.

Stocks? Ugly. Markets don’t like the Trump Administration’s trade and tariff policies, nor the economic uncertainty created by the fact they’re changing day-to-day and week-to-week. Policymakers say the short-term pain will be worth the long-term gain. But there’s nothing encouraging happening in former leading sectors like technology, as the performance of the Invesco QQQ Trust (QQQ) makes clear. Small caps and other groups that originally rallied after the election are also giving up the ghost.

Gold? Rock solid. I don’t know if my “$3K in Q1” prediction will pan out. We’re running out of time, and gold was recently trading about $80-per-ounce shy of the $3,000 mark. But amid strong central bank buying, a plunging dollar, and rising uncertainty, it’s doing exactly what it should be doing. Rallying. The SPDR Gold Shares (GLD) is up about 11% year-to-date.

Volatility? Through the roof. At the beginning of February, I said that the “Trump 2.0” regime would feature more market volatility. It’s only mid-March…but the iPath S&P 500 VIX Short-Term Futures ETN (VXX) is already up 30% on the year! As Shaggy from Scooby Doo might say: “Zoinks!”

Bottom line? Credit markets are getting squishy. Stock markets are in bad shape. Gold is doing just fine. And volatility is on the rise. That makes this a good time to keep risk dialed back.

In this educational and eye-opening briefing, Kevin Davitt, Head of Index Options Content at Nasdaq, explains the distinguishing characteristics of the NDX today versus 1985. He also tells you why they matter — and what’s working in 2025 through the lens of index options.

SPX: Dissecting the Downdraft – and Where it Might Halt

👉️ TICKER: SPXThe ongoing story during this downdraft is that the stock market is just not seeing bidders as prices cascade lower. On Monday, the S&P 500 (SPX) fell 2.7% and the Nasdaq and Nasdaq 100 were off about 4%. The “500” slid through the 50% retracement and chart support in the 5,650 region like it wasn't even there, notes John Eade, president of Argus Research.

Three Reasons Traders Shouldn't Overreact to Rising Volatility

Stocks have been cruising since October 2023. But trading is getting choppier as macro risks pile up. Every week seems fraught with fresh tape bombs. Before you decide to hit the exits, consider three things about uncertain times and rising volatility, writes Alec Young, contributor at MAPsignals.

What did you think of today's newsletter? |