- MoneyShow's Trading Insights

- Posts

- TI 03/05/25

TI 03/05/25

Mike Larson | Editor-in-Chief

The verdict from markets is in: We don’t want a trade war!

In the last few days, stocks have tanked, volatility has surged, gold has rebounded, and the dollar has declined. Treasury yields have also plunged.

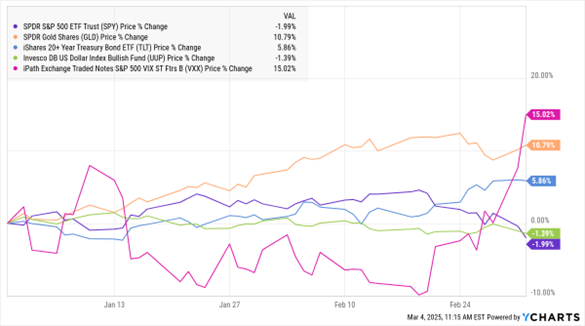

Today’s MoneyShow Chart of the Day shows the year-to-date percentage change in the SPDR S&P 500 ETF Trust (SPY), SPDR Gold Shares ETF (GLD), iShares 20+ Year Treasury Bond ETF (TLT), Invesco DB US Dollar Index Bullish Fund (UUP), and the iPath ETN S&P 500 VIX (VXX). The volatility-tracking VXX is now UP 15% on the year, while the SPY is now down around 2%. Gold has risen almost 11%, while the dollar ETF has lost 1.4%.

SPY, GLD, TLT, UUP, VXX (YTD % Change)

Meanwhile, the 3-month/10-year Treasury yield curve has re-inverted. Plus, the 2-year/10-year curve has been cut in half (to as low as 20 basis points from around 40 at the beginning of 2025). Curve inversions are a slowdown/recession warning sign, one seen ahead of many downturns in the 21st and 20th centuries.

The Trump Administration will argue this is “necessary” pain as part of a rebalancing process for global trade and the US economy. That’s what Treasury Secretary Scott Bessent tried to do on Tuesday.

But this is a TRADING column. Personal politics don’t matter. Markets do.

The message they’re sending out is clear: The actions being taken are negative for risk appetite, growth, and asset prices. So, be sure to factor that in if you’re trading stocks, bonds, currencies, or precious metals.

Garrett Patten, senior analyst at ElliottWaveTrader, recently shared his chart analysis on individual stocks that may be setting up for moves in 2025. Garrett, who co-hosts Stock Waves and the Metals & Mining services at EWT in addition to hosting World Markets, also shared his insights into which areas of the market will present the best opportunities this year. Check it out HERE.

Rotation, Sentiment, and What to Watch in this Volatile Market

👉️ TICKERS: IWF, IWO, IWD, IWN, SPYTraders and Investors have so many questions right now about the coming months and quarters. A big theme on a conference call I just hosted was the massive rotation that we're seeing underneath the surface, highlights JC Parets, founder of AllStarCharts.

TNX: What Treasury Yields are Saying About Stocks Here

👉️ TICKERS: IEF, TLT, TNX, SPYThe S&P 500 just registered its second down week in a row after hitting an all-time high as recently as February 19. Meanwhile, US Treasury yields dropped five weeks in a row, which is even more telling, notes Ivan Martchev, investment strategist at Navellier & Associates.

What did you think of today's newsletter? |