- MoneyShow's Trading Insights

- Posts

- TI 03/03/25

TI 03/03/25

Mike Larson | Editor-in-Chief

Close...but no cigar. That’s how I’d characterize inflation these days, at least from a policymaker perspective.

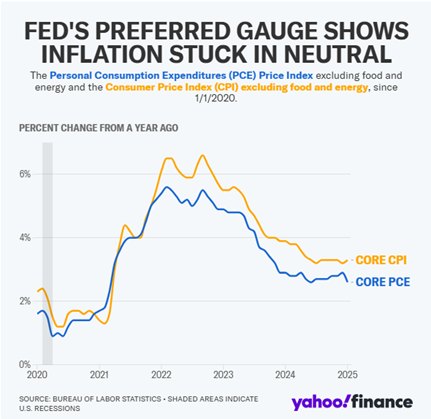

Check out the MoneyShow Chart of the Day here. It shows the year-over-year change in the two main “core” (excluding food and energy) inflation readings we get each month. One is the Consumer Price Index that was released in mid-February and the other is the Personal Consumption Expenditures Price Index that we got on Friday.

The core PCE rose just 2.6% year-over-year in January, down from 2.9% in December and the smallest increase in seven months. That’s the good news.

On the other hand, the CPI rose 3.3% YOY in January. That was up from 3.2% in December, halting progress toward the 2s. So...bad news.

Right now, the federal funds rate target range is 4.25% - 4.5%. The Federal Reserve’s next policy meeting ends on March 19. Rate futures markets are pricing in only a very small chance (less than a 7% probability) of another 25-basis point cut then. That’s far below the 31% chance being priced in at the end of January.

You have to go out to the June meeting to find the percentage of a cut being greater than a coin flip (56% as of Friday). And it’ll take more PCE-ish data – vs. CPI-ish data – to get those figures to swing further in the doves’ favor. That, in turn, means traders will be trading without the benefit of an implied “Powell Put” for at least a while longer.

Markus Heitkoetter of Rockwell Trading Services joined us for the 2025 MoneyShow/TradersEXPO Las Vegas in February. In this “60 Seconds with a MoneyShow Expert” segment recorded on-site, he shares his top options trading tips for this market environment.

SPX: Will the Pullback End Soon? Or is the Weekly Uptrend Over?

👉️ TICKER: SPYNow that a pullback in US stock markets has begun, where will it end? The answer can be found by examining the current market trend in different time frames, writes Ian Murphy, founder of Murphy Trading.

NVDA: Levels, Trends to Watch if You're Trading this Tech Titan

Oh boy, did it get ugly last week when stocks collapsed as the algos went into “sell mode.” I think someone hit the wrong button, but it was what it was. There were no surprises to speak of, with Nvidia Corp. (NVDA) blowing the roof off the house, writes Kenny Polcari, chief market strategist at SlateStone Wealth.

What did you think of today's newsletter? |