- MoneyShow's Trading Insights

- Posts

- TI 02/28/25

TI 02/28/25

Mike Larson | Editor-in-Chief

The Magnificent Seven aren’t looking so magnificent anymore. In fact, they’re not even looking good.

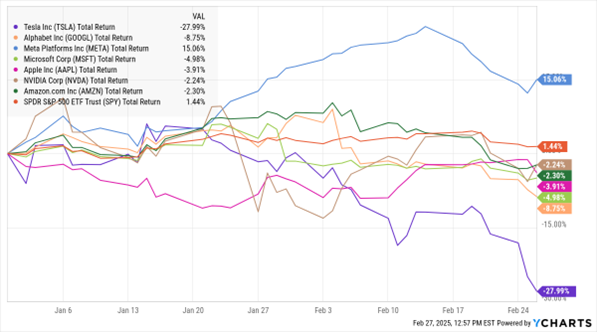

Check out the MoneyShow Chart of the Day below. It shows the year-to-date performance of the Mag 7 stocks – Tesla Inc. (TSLA), Alphabet Inc. (GOOGL), Meta Platforms Inc. (META), Microsoft Corp. (MSFT), Apple Inc. (AAPL), Nvidia Corp. (NVDA), and Amazon.com Inc. (AMZN) – and the SPDR S&P 500 ETF (SPY).

The Not-So-Magnificent 7 (YTD & Change)

The SPY was recently up about 1.4% YTD. Six out of seven of the “Magnificents” are underperforming that. Tesla is in freefall.

Only Meta is bucking the trend. But even shares of the social media and digital advertising giant are giving back some of their recent gains.

What gives? TSLA is getting whacked by the unwinding of “Trump Trades” put on in the wake of the 2024 election. Investors are increasingly worried about stubborn inflation and the impact of tariffs on growth and consumer prices, so they’re dumping the stuff they previously bought.

Other tech names are getting hit by concerns over the future level of AI spending (and whether all the money spent to date will pay off with higher profit growth down the road). Plus, we’re seeing broader rotational action. Some investors are targeting left-for-dead defensive and value stocks. Others are rotating into S&P sectors like financials and real estate.

My advice? Recognize. Then adapt. Don’t get stuck focusing solely on OLD winners. Focus more on NEW ones.

How did Gav Blaxberg turn 40 hours a week in his mom’s house into a five-billion-impression empire? In this episode of the MoneyShow MoneyMasters Podcast, the CEO of Wolf Financial reveals how he went from a frustrated finance student to one of the most influential voices in financial education.

His insights might just change the way you think about investing.

SPY: How to Trade When “Outlier” Events Sideswipe Stocks

👉️ TICKER: SPYIt happens. An outlier event collapses the SPDR S&P 500 ETF (SPY). It could be something as innocuous as an economic report that, at other times, would hardly move the needle. But this is an occasion when patience most often pays, although you may have to wait several days to recover from this slip, notes Hugh Grossman, founder of DayTradeSPY.

Energy: Prices Fall Despite Cold...But Keep an Eye on the Middle East

👉️ TICKER: USO

It is kind of crazy that we’ve had one of the coldest weeks ever and yet we saw a big build in distillate inventories. Did everyone turn their heat off? Meanwhile, crude oil sold off earlier this week partly because of President Trump’s comments on the possibility of a ceasefire between Russia and Ukraine, advises Phil Flynn, senior energy analyst at The PRICE Futures Group.